European-focused oil and gas company Europa has more than doubled its net oil reserves, chairman Bill Adamson will tell shareholders today.

Speaking at the company’s AGM later today, Mr Adamson will hail the success of the company in boosting its net mean risked resources to 43 million barrels of oil equivalent, compared with 27 million barrels a year ago.

This increase of more than 50%, says Mr Adamson, is due to the addition of gross mean unrisked resources of 1.6 million barrels for the Kiernan prospect offshore Ireland and a six fold jump to 416 billion cubic feet (cbf) for the shallow gas prospect at Bernex, onshore France.

Mr Adamson says the company’s UK portfolio of three producing fields, which generated around £4.5 million revenues in the last financial year, continue to help fund exploration work.

This includes Europa’s share of 2D seismic acquisition costs on the 50% owned PEDL 181 licence in East Lincolnshire. The company will shortly release an updated geological model and a forward plan for this licence.

“In addition, we are funded to cover our share of drilling costs at the Wressle prospect in the East Midlands where a well is expected to spud early in 2014,” says Mr Adamson.

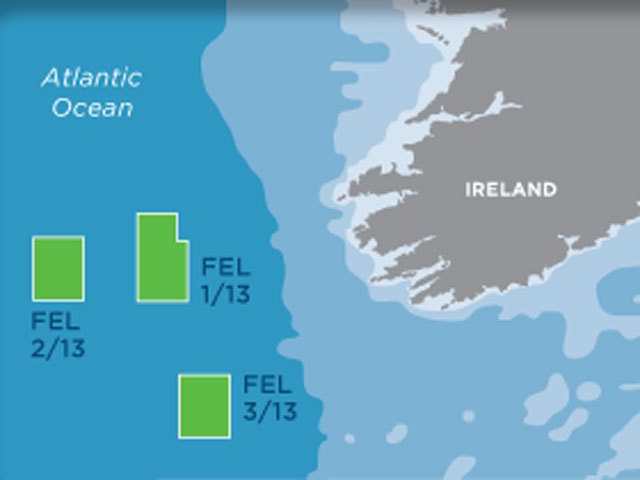

Europa and its partner in offshore Ireland, Kosmos Energy, have recently acquired 3D seismic for their Irish blocks in the South Porcupine Basin.

Mr Adamson says it is hoped interpretation of the 3D data will “significantly de-risk the prospectivity already identified” and could potentially lead to the duo drilling a well on one or both of the blocks in 2015/16.

“We are also confident that 2014 may see a umber of key value triggers for our 100% owned French permit,” Mr Adamson says.

“In tandem with launching a farm-out, we have already commenced the planning process to drill a well to test the 416 bcf Berenx Shallow gas prospect. Subject to completing a farm-out agreement or similar funding, we could be drilling a well to test the shallow gas prospectivity within the next 18 months.”