There’s a hotting-up M&A market in the UK North Sea, including some of the largest players like Harbour Energy. We take a look at where deals are being made.

“The majority of North Sea opportunities are dominated by large production portfolios,” noted Welligence’s Dave Moseley.

“With price volatility having reduced in recent months, buyers and sellers may find it easier to agree near-term prices, however the trend of increasing trigger or contingent payments is expected to remain as companies hedge against key risks such as project delivery, performance and long-term pricing.”

Harbour, Eni, Shell, Viaro, Prax and others have been in the headlines of late. See our roundup below.

Harbour merger with Talos

The UK’s largest producer of oil and gas is reportedly to be in merger talks with the US Talos Energy in a move that would Harbour Energy list on the New York Stock Exchange and provide more opportunities for operations overseas.

There has not been a value confirmed for the merger with the US business with an estimated value of $1.8 billion.

Talos Energy stock climbed 11% in value following the news first being reported.

Earlier this year, Harbour Energy (LON: HBR) said the windfall tax has “wiped out” its profits for 2022.

However, the firm, which is cutting hundreds of jobs in Aberdeen, went on to say it has a “solid financial position” and announced $300m of new buybacks and dividends for shareholders.

Neptune and Eni

The Aberdeen-based Neptune Energy has been in talks to be acquired by Italian oil and gas giant ENI with discussions heating up as the latter increased its offer.

The Italian energy firm has agreed to up its initial offer and is now willing to spend between $5 billion to $6bn, reports say.

Talks have been going ahead with progress being made, however, a takeover is not set in stone.

The ENI takeover was reported to have cooled off in March, however, last week it was reported that talks were heating up.

The Italian firm Eni’s interest in a deal dropped following a reported disagreement over the price until Reuters reported that talks had resumed between the two businesses.

Earlier this year it was reported that Neptune, which is backed by private equity firms Carlyle Group Inc. and CVC Capital Partners, is working with advisers as it speaks to potential buyers.

ENI is not the only European energy juggernaut that has been sniffing around Neptune, French supermajor TotalEnergies was also reported as showing interest earlier this year.

The French company was among suitors that held early-stage talks with Neptune about a possible takeover, according to people with knowledge of the matter.

Shell Cambo

Last month Shell launched a fresh sales process for its 30% stake in the UK’s Cambo field, the firm’s former chief executive, Ben van Beurden, previously said “economics are simply not supportive enough” to justify the supermajor’s involvement.

Mr Moseley said: “Companies looking for investment opportunities in large, robust greenfield projects face a struggle for choice in the UK, but some options exist. Shell is seeking to sell its 30% interest in Cambo, along with operator Ithaca potentially offering up to 19.99% interest.

“With ONE-Dyas having previously exited Jackdaw, Shell may also be open to reducing its position.”

Initially looking to sell in 2022, Shell has made another bid to offload its stake in the west of Shetland development, which is the second-largest untapped field in the UK.

Shell (LON: SHEL) was first said to have been putting its interest up for sale in August of last year, though this was never confirmed by the operator.

A crucial final investment decision (FID) has been in limbo due to the sale, and other factors like the UK windfall tax which Cambo operator Ithaca said could hit the timeline.

Another outcome of the agreement with Ithaca could be that the operator acquires Shell’s stake in Cambo.

Shell could alternatively sell its entire interest in Cambo and, if a potential buyer wanted further exposure, Ithaca could sell up to 19.99% of its own interest.

No matter what happens, one of these options needs to be achieved to get the project to FID.

Any remaining portion which Shell might retain under the process could still be sold to another party, while Ithaca could acquire it.

In all scenarios, Ithaca would retain at least 50% working interest.

Prax take over Hurricane Energy following court approval

Last week Prax Group received approval from the courts on its acquisition of the West of Shetland firm, Hurricane Energy.

The North Sea operator was valued at £250m ahead of the sale.

Directors of Hurricane resigned with immediate effect following the court ruling and shares of the firm on the AIM market are being cancelled.

London-headquartered Prax is part of midstream-focused State Oil and acquired the Lindsey oil refinery at Immingham in 2021 from TotalEnergies.

Ahead of the court decision, Hurrican Energy chairman, Philip Wolfe said the prospect of the takeover was “exciting” for his business.

Mr Wolfe wrote in Hurricane’s 2022 report: “Should the Scheme be sanctioned by the Court, I believe Hurricane has an exciting future as part of the wider Prax organisation.”

Reflecting on the firm’s performance, the chief executive Antony Maris, explained that 2022 had been “both very challenging and highly successful” as it made $113.6 million before tax.

Before dishing out $1.7 million in tax, Underlying profit before tax was up by more the 10 times that of 2021’s figures.

Neo with Buchan field

While on the subject of acquiring stakes in North Sea oil fields, the Aberdeen-based NEO Energy is looking to pick up half the shares in the Buchan and Verbier licence.

Both licence agreements are planned for June 2023.

Owners, Jersey Oil and Gas (LON: JOG), are selling half the shares in the developments to the firm after announcing it was looking to sell the stake late last year.

At the time of the announcement Jersey said it hoped to sell by the end of Q1 2023 “if not by the end of the year”, the firm said uncertainty like the windfall tax has “slowed progress” but welcomed the investment allowance attached to it.

The North Sea Transition Authority (NSTA) last week granted a licence extension to Jersey Oil and Gas for its Buchan field as part of the Greater Buchan Area farm-out transaction.

The second term of the Buchan licence has been extended by 18 months to 28 February 2025. This was granted to offer the firm enough time to prepare a Field Development Plan (FDP) for the redevelopment of the Buchan field, which is planned for submission to the NSTA “during 2024”.

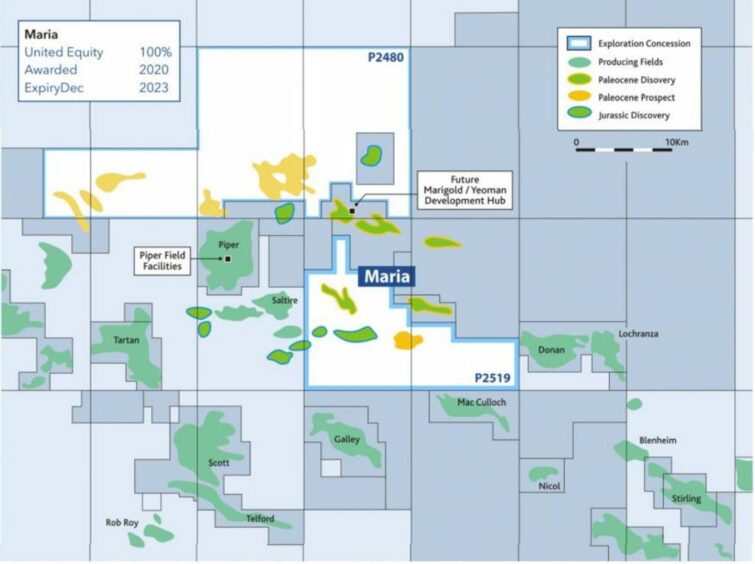

United Oil and Gas Maria

Last month United Oil and Gas (LON: UOG) announced it had entered into a binding asset purchase agreement with Quattro Energy.

The deal covers the conditional sale of the UK Central North Sea Licence containing the Maria discovery.

The firms involved have not disclosed the value of the deal, however, it will see Quattro Energy take on Licence P2519, located in Block 15/18e.

The two firms have agreed on an extension of the long stop date which was originally 16th April 2023, pushing it back to the 17th of May.

This it to allow additional time for the asset purchase agreement conditions required for completion to be “satisfied”.

United says that there will be a further update to the sale processes “in due course.”

Earlier this year, a contingent resources audit conducted by Gaffney, Cline and Associates, found the Maria discovery holds up to 17.7 million barrels of oil and gas, however, the research does indicate a best estimate of 10.2 mmboe.

Currently, United has a 100% stake in the development.

Viaro buys Hartshead Resources

Earlier this year Viaro struck a £105 million deal to take on for series of Hartshead UK North Sea fields.

Under the deal, Viaro will be acquiring 60% of the P2607 Licence, which contains the Anning and Somerville fields, as well as the Hodgkin and Lovelace plays, marks a “major milestone for the company” says Hartshead.

Hartshead believes the permit to hold 2P reserves of 301.5 billion cubic feet of gas, equivalent to around 52 million barrels of oil.

It has not been confirmed when Viaro is taking over this stake, however, Heartshead will retain operatorship for now, and transfer control to Viaro “at a mutually agreed future date”.

Hartshead CEO Chris Lewis said at the time of the announcement of the deal: “The successful execution of a farm-out agreement with RockRose materially de-risks the Phase I development of the Anning and Somerville gas fields by securing over A$536m of gross project expenditure, provides technical and commercial validation of our gas development and implies a material uplift in value for the project.

Honourable mentions:

The M&A market is not contained to the UK North Sea, European firms and assets are making waves in the space.

The Welligence North Sea vice president outlined: “Neptune’s E&P business, along with Shell and ExxonMobil’s Southern North Sea assets, look the most likely to transact in the near term.

“There is a wealth of opportunity, particularly in the UK, for companies seeking to acquire production, with over 250,000 boepd currently available on the market including corporate portfolios where sales processes have stalled such as ONE-Dyas and CNOOC.”

Spirit Energy

Recently, the North Sea operator Spirit Energy said it suffered an “exceptional loss” relating to the sale of its Norwegian business in 2022.

At the end of May last year, the company completed the deal to sell its full portfolio of oil and gas assets offshore Norway to Sval Energi, and its interests in the Statfjord field to Equinor.

The sale closed for a headline consideration of around £800 million, for a loss of £183m for the period, Spirit reported in its company accounts recently.

The group announced a deal to offload the majority of its Norwegian business to private equity-backed Sval Energi in December 2021, alongside a separate $50m agreement to hand minority sakes in Statfjord to Equinor.

Waldorf

Not all plans to secure deals in the M&A market have gone well recently.

Waldorf Production has blamed the Netherlands’ solidarity tax and uncertainty over decommissioning commitments for aborting its planned acquisition of TAQA and Dana assets.

Mr Moseley explained the situation: “Fiscal instability is harder to accommodate – such changes in the Netherlands reportedly contributed to Waldorf failing to follow through with its acquisition of TAQA, whilst in the UK, the EPL is driving companies to either postpone investment or direct investment elsewhere.

“Whilst at this stage the impact appears primarily limited to companies reducing development drilling, it may only be a matter of time before it drives companies to sell larger business units.”

In October of last year, Waldorf said it would be taking over the Netherlands-based business of fellow North Sea producers TAQA and Dana Petroleum for an undisclosed sum.

However, during an investor call for the company’s Q1 results this year, chief executive Erik Brodahl said the environment had made the planned deal “impossible to close.”

The sale would have seen Dana offload interests in 21 oil and gas fields including the De Ruyter, Hanze, Van Ghent and Van Nes fields in the Dutch sector.

TAQA’s assets included the P15 and P18 blocks, containing oil and gas production facilities spanning the central P15-ACD complex and several satellite production platforms, as well as the Bergen II onshore area.

TAQA later announced that the completion did not occur in accordance with its terms, and was terminated on 28 March 2023.

Recommended for you

© AJL

© AJL © Ithaca Energy

© Ithaca Energy © Supplied by Shell

© Supplied by Shell © Hurricane Energy

© Hurricane Energy © JOG

© JOG © United Oil and Gas

© United Oil and Gas © Supplied by Facebook/Amber Johnson

© Supplied by Facebook/Amber Johnson © Supplied by Roddie Reid/ DCT

© Supplied by Roddie Reid/ DCT © Supplied by ?yvind Hagen / Equin

© Supplied by ?yvind Hagen / Equin © Supplied by Dana Petroleum

© Supplied by Dana Petroleum