A senior figure in the Conservative party is pushing the government to take another look at current rules for contractors.

Writing in The Telegraph, David Davis called for a “serious plan” around “jobs, wages, standards of living”, including axing IR35 reforms.

Doing so “would hand greater freedom to the self-employed and smaller businesses”, he said, while helping to create a tax structure that “encourages investment and rewards hard work”.

The former Brexit secretary is not the first name from within the Conservative party to call on Rishi Sunak to address off-payroll working tax rules.

Backbencher Sir John Redwood told the Prime Minister in February to reverse the reforms in order to “promote” and “make it easier for people to get into self-employment”.

Last year Chancellor Jeremy Hunt scrapped plans, initially unveiled by Liz Truss, to ditch IR35 reforms, which were rolled out for the private sector in 2021.

Given the decision to do away with the rules was met with jubilation, the reversal sparked fury, and even claims it could cost the Conservatives government.

Now, with a general election starting to loom large, and Labour tipped to win, Mr Davis says Westminster should revisit the issue.

He said: “We are within striking distance. But to overtake Labour will require more than just competence. The public still needs a vision for Britain that meets their aspirations. Conservatives believe in an open, meritocratic society, a flourishing property-owning democracy, and we must provide it. So by “vision”, I do not mean some high-flown conference rhetoric – I mean answers to the very real problems people face in their daily lives.

“Most elections are decided on economic issues, and the next will be no different. Jobs, wages, standards of living: these require a serious plan. We need a tax structure that encourages investment and rewards hard work. The much touted 2 per cent off income tax would be a start, but is not enough by itself. There are other low-cost measures that could have dramatic effects. The cancellation of IR35, for instance, would hand greater freedom to the self-employed and smaller businesses.”

Implemented by Her Majesty’s Revenue and Customs (HMRC), IR35 reforms put the responsibility on firms to decide the status of contractors.

If the work they carried out is similar to a regular employees, they are deemed to be inside IR35, and have to pay more tax.

Businesses face lofty fines if they’re found to not be IR35 compliant, leading many to implement blanket rules.

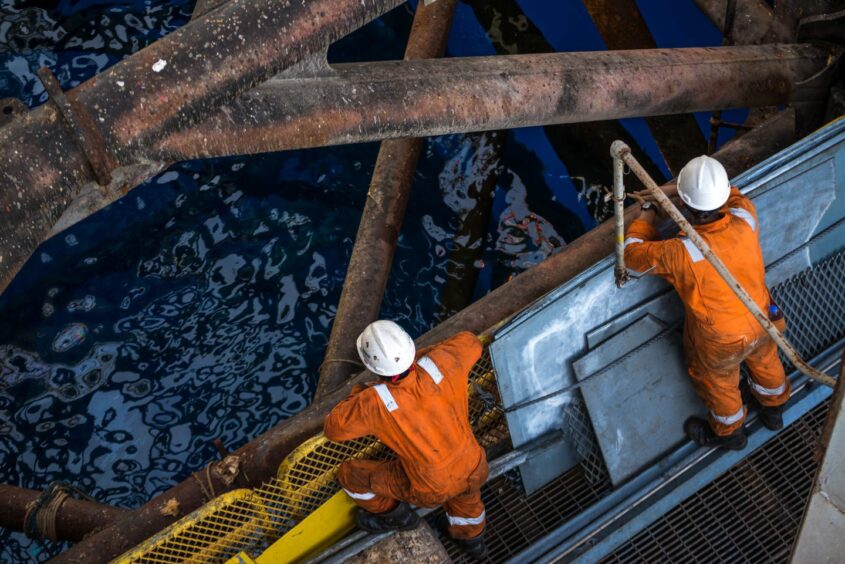

Given oil and gas companies frequent use of contractors, the changes have had a big impact on the sector, and some blame it for the ongoing energy skills shortage.

Research has also found that the intricacies of the current system are were putting businesses off using contractors, and has reduced the pool of freelancers.

Dave Chaplin, chief executive of IR35 compliance firm IR35 Shield welcomed David Davis’s call, saying: “The disaster that is IR35 version 2, namely Off-payroll, is what happens when people living in ivory towers at HMRC invent new taxes and get them waived through Parliament by MPs who are too busy focused on the Boris Johnson circus and cheap headlines, instead of carefully scrutinising legislation.

“David Davis MP and other MPs understood that Off-payroll was damaging and tried to delay it for at least 2 years, and almost succeeded.

“When I led the Stop The Off-payroll Tax Campaign, I was told that the reason the delay vote on 1st July 2020 was prevented from getting enough votes, was due to personal intervention by Boris Johnson. But, as David Davis MP says, that circus has now left town.

“Out of the near half a million contractors, due to be affected by IR35, only 3,868 joined the campaign and tried to fight. Imagine what would happen if the other 496,000 spoke to their MPs as we head into the next election. It’s game on.”

© PA

© PA