Heated demand in Australia, Mexico and West Africa has seen the global market for the latest generation of semi-submersible rigs reach 100% utilisation for the first time in nearly a decade.

Data from Westwood Global Energy’s RigLogix platform shows committed utilisation of sixth-gen, harsh environment semisubs has risen 14% in the last six months, selling out the fleet market for the first time since 2014.

The figures include rigs either on hire or with an upcoming contract, across a fleet of some 27 active rigs.

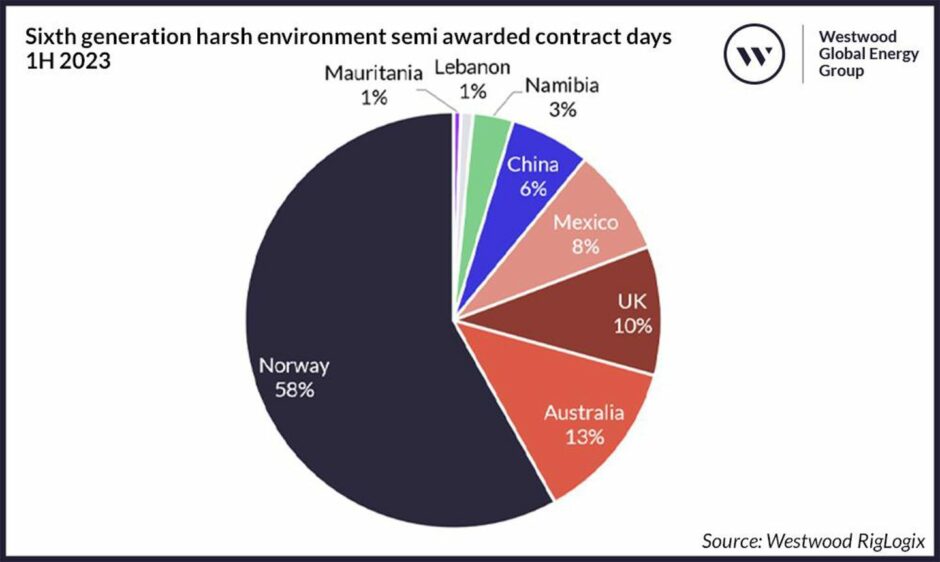

While Europe remains the largest source of demand with more than two-thirds of contracted days awarded this year, several rigs are being confirmed for new work or extensions in other regions.

It comes amid multiple warnings from drilling contractors that rigs are exiting the North Sea, leaving operators in Norway and the UK with higher prices and fewer available units.

The International Association of Drilling Contractors (IADC) wrote to politicians earlier this year warning of an “energy supply catastrophe” if investment decline in the sector isn’t stopped, amid a “migration” of rigs and equipment out of the region.

Westwood analysis shows that while Norway retains the greatest share, units are increasingly heading to other regions such as Australia, where Transocean is to relocate two of its units for three new long-term assignments.

“Mexico, China and Namibia have also contributed considerable demand thus far in 2023, and all are expected to remain critical for this fleet going forward,” added RigLogix director Teresa Wilkie.

Dayrates up by a third

In tandem, dayrates for recent contract fixtures have also risen with some climbing above $400,000 – a level not seen since 2015.

Average dayrates (excluding priced contract options) for semisub contracts year-to-date now sit at $394,000 – up almost one-third on the full-year average for 2022, and the highest average since 2014.

Ms Wilkie notes that Transocean and Odfjell Drilling have been especially successful at driving higher rates for their assets this year, securing new deals with rates reportedly as high as $484,000 for one Australian deployment, and $420,000 in Norway, though these contracts may include additional services.

These fixtures do not begin until the first quarter of 2025 and second quarter of 2024, respectively.

“For those operators looking to secure a unit, the earliest availability appears to be late 1Q 2024 when the Transocean Barents comes off hire. However, it is already being bid on follow-on opportunities, as is the case for those units rolling off contract in the second quarter,” she continued.

She suggests the outlook for this fleet conrtineus to be “very bright” particularly as several multi-year tenders are taken to market for work off Norway,

Ms Wilkie says this suggests operators are recognising “shrinking availability, fear of missing out on the right specification assets for drilling campaigns and, most worryingly, rising dayrates that can affect overall project economics.”

In the meantime the firm suggests dayrates for this class of rig are set to continue rising on the back of buoyant demand and dwindling supply, amid a lack of newbuild assets and/or reactivation candidates, which have helped save escalation in the drillship and jack-up markets.

Ms Wilkie says there are just three cold-stacked sixth-gen semisubs that could be added to the fleet if reactivated, and only four newbuilds in shipyards.

“One of the latter is the North Dragon, which has been secured for a long-term campaign in Mexico. The remaining three units, the sixth generation Beacon Pacific and the seventh generation ex-Awilco newbuilds – Nordic Spring and Nordic Winter – are all being bid on current tenders in the market.”

Accordingly, Westwood expects dayrates to continue increasing worldwide over its five-year forecast period to 2027, with rates secured at or above $500,000 for contracts beginning in late 2024 and early 2025.

The analysis chimes with that of consultancy Wood Mackenzie, which forecast that dayrates for “highly-prized, advantaged ultra-deepwater rigs” could hit $500,000 before the end of this year.

Recommended for you

© Supplied by RigLogix/Westwood

© Supplied by RigLogix/Westwood