The UK’s gas production is far from meeting the country’s demand, “we absolutely do not have a proper plan” says Richard Lowes, senior associate at the Regulatory Assistance Project.

Mr Lowes says, “I feel like I’m watching a slow-motion train crash,” when thinking about how gas production is set to decline compared to the growing demand for hydrocarbons in the UK.

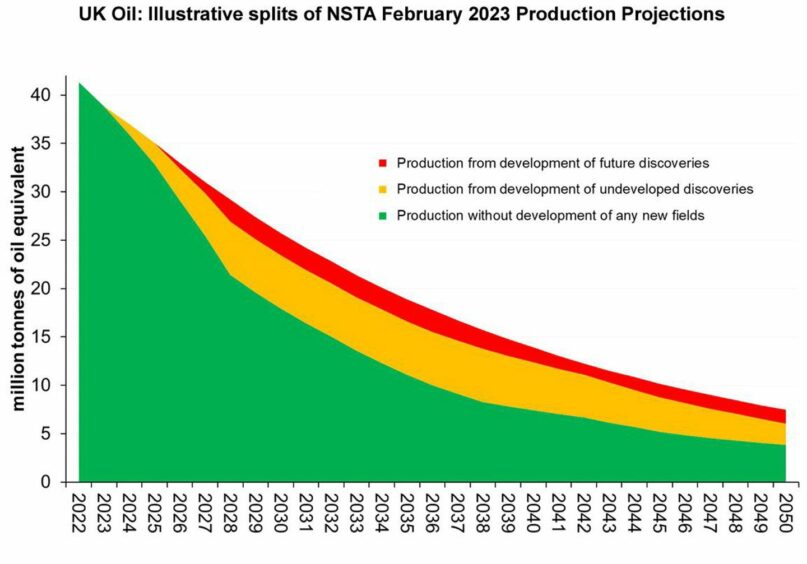

The senior associate for the energy transition NGO points to information published by the North Sea Transition Authority (NSTA) in February that shows how production levels in the UK will drop every year until 2050.

The NSTA graph shows that even with production from currently undeveloped discoveries and future discoveries, the amount of hydrocarbons produced in the UK will continue to decline.

“Do people realise just how much gas the UK imports? And how much and how quickly remaining gas production is expected to fall?,” he asked on social media.

Paul de Leeuw, director of the Robert Gordon University (RGU) Energy Transition Institute, agreed with Mr Lowes’ assessment of the sources he provided, saying that “supply exceeds the projected demands of the country and rest will be made up from imports.”

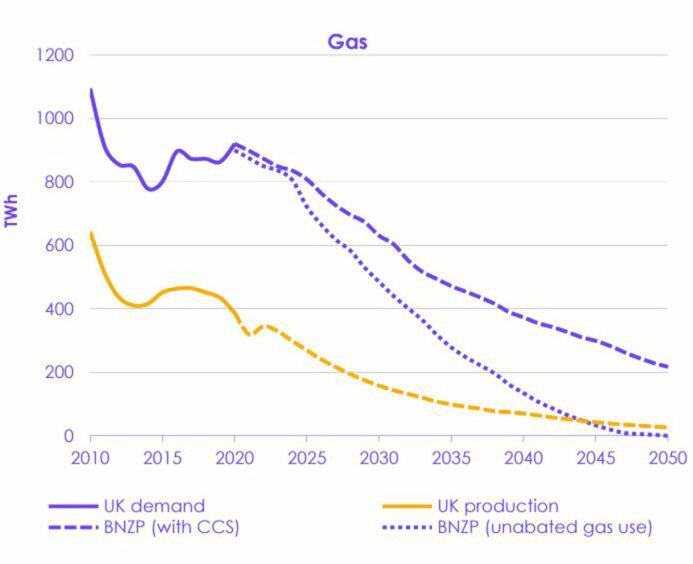

The senior associate also outlined production levels when compared with gas demand in the UK. He highlights data from the Climate Change Committee (CCC) that shows the UK’s gas demand has increased alongside imports, however, domestic production has taken a downturn.

When Kwasi Kwarteng was named the chancellor of the Exchequer for Liz Truss’ short-lived government last year, CCC wrote an open letter to the newly appointed chancellor on a proposed climate checkpoint for North Sea licensing.

This letter shows that CCC’s ‘Balanced Net Zero Pathway’ is with higher than predicted production from the UK.

In this scenario, gas production would drop below UK needs under the balanced net zero pathway by around 2045, without the use of carbon capture storage.

However, with the use of CCS, gas production while sticking to the CCC’s pathway remains lower than the amount of gas required to meet demand.

Reducing carbon intensity or maximising production?

Mr de Leeuw says that this analysis of UK gas supply and demand is “a simple story” and that focus should be on the “need to get a net zero. We need to get the carbon intensity down and we need to really phase down fossil fuels.”

The RGU director added: “The reality is, the lower the production is the more we will import.

“That’s when this gets really tricky because at the moment if you want to stop new investment and you still have a continued demand, all you handle doing is potentially importing at a higher carbon footprint and that’s a big message you get from industry.”

In the CCC’s open letter to the former chancellor, it writes: “The UK will continue to be a net importer of fossil fuels for the foreseeable future, implying there may be emissions advantages to UK production replacing imports.”

However, ultimately the Climate Change Committee ultimately suggested a presumption against new oil and gas.

It said: “We would support a tighter limit on production, with stringent tests and a presumption against exploration.”

Recently, the UK energy security secretary, Grant Shapps, said that if the government “granted every single conceivable licence to the North Sea” the country would still be within the Intergovernmental Panel on Climate Change’s guidelines.

Off the back of this, Mr Shapps said that he looks to “max out” the UK North Sea’s oil and gas reserves, claiming that carbon emissions will still decline at “twice the rate” outlined by the Intergovernmental Panel on Climate Change.

Inflation in the offshore wind sector

A further complication Mr de Leeuw discussed was transitioning to renewable sources as hydrocarbon resources deplete.

He said: “The big question here is what’s the market mechanism of accelerating what has been quite a complicated picture, as we see what happens to the cost increases in the wind sector.”

The cost of developing offshore wind is rising, as demonstrated by Vattenfall as it put its Norfolk Boreas project on hold due to inflation.

The wind developer claimed to see a 40% rise in costs relating to the project, confirming it had “decided to stop the development of Norfolk Boreas in its current form” and will “examine the best way forward for the entire Norfolk Zone.”

Mr de Leeuw continues: “If wind is becoming more expensive, the risk is the amount of power we produce less wind power might be lower and that might move to the right in terms of timing.”

Not being able to replace the country’s current energy demands with lower carbon alternatives puts a “spotlight on what we’re going to do to make the energy system work in the UK,” the RGU Energy Transition Institute director explains.

For the UK to continue at “full power” the country needs to work on its supply chain for wind infrastructure and rethink its contract for differences mechanism, says Mr de Leeuw.

He says: “The wind sector might be at risk where we don’t have everything moving at the same speed in the same order of magnitude, and that is a really not good outcome.”

Supporting the supply chain and keeping momentum

To combat this, the country must make sure that the mechanism in place for contracts for differences “allows higher prices” to help the wind sector, the RGU director told Energy Voice.

In addition to this, the supply chain in the UK has to see support in order to meet the demand for turbines.

Paul de Leeuw suggests a “standardised design” for turbines so that the UK can build them cheaper.

Tackling the issue of grid connection for offshore wind farms would also keep “momentum” building in the sector, he says.

“That will require industry agreement and require supply chain alignment,” Mr de Leeuw concludes.

The UK’s offshore wind champion, Tim Pick, has also supported a change to CFD mechanisms to support the supply chain.

In March this year, Mr Pick suggested “introducing Non-Price Factors into the CfD auction process.”

The offshore wind champion suggested that the government promotes a circular economy by incentivising the use of “Green Steel and wider industrial decarbonisation” as it would reduce dependency on critical minerals and create green jobs.

Mr de Leeuw adds: “Even if we don’t do that, we need to make sure that we have a system to keep the UK running and keep the power going. That will require that we have a whole mechanism, keeping gas as a system, as a backup.

“But if you want to do that, what’s the best gas you can get, it’s on your doorstep. You want to be at the beginning of a pipe, not the end.

“That’s why the debate for energy security and supply but also for the Sustainability and affordability element is so important.”

Recommended for you

© Supplied by NSTA

© Supplied by NSTA © Supplied by CCC

© Supplied by CCC