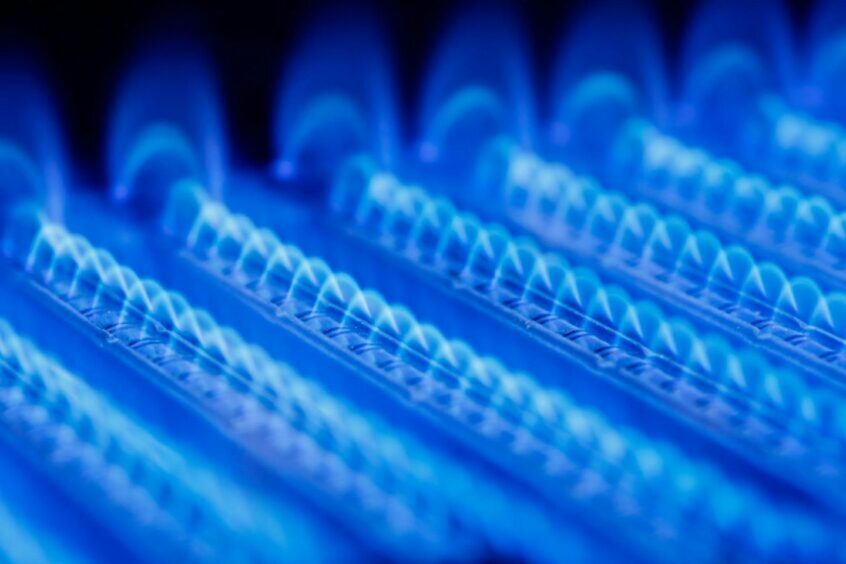

Recently, Prime Minister Rishi Sunak announced plans to water down the UK’s phasing out of gas boilers in homes as part of a rollback on green energy policies.

Before the Conservative party leader introduced this change in legislation, the UK government had a vision to grow the heat pump market to 600,000 installations per year by 2028 and up to 1.9 million a year by 2035.

The policy objectives underpinning this growth in heat pumps included a ban on new oil and LPG boilers from 2026 and a plan to ban new gas boilers in new-build houses from 2026 (currently under consultation as part of the Future Homes Standard).

Furthermore, ahead of Suank’s changes, there was a ban on new gas boilers in existing properties (for example, predominantly replacement boilers) set to come into place in 2035.

However, the changes served to push back the ban on new oil/LPG boilers to 2035 and have watered down the plan to ban new gas boilers in existing properties from 2035, giving an exemption for approximately 20% of households.

At the time of this announcement, energy analytics firm Wood Mackenzie published a report predicting that low demand for gas in Europe would see the price of European gas fall by 20% by summer next year.

Energy Voice spoke to the analysts to see how this update in UK policy would impact its predictions for gas consumption.

Watered down UK boiler policy ‘slow the reduction in residential gas demand’

Wood Mac explained that the UK government has increased the Boiler Upgrade Grant by 50% to £7500 for those who want to transition in the meantime.

The announcement was silent on the plan to ban gas boilers in new-builds but there is a risk that this is also watered down.

Wood Mac said: “Significantly, the government announced that they will scrap the planned policy to force landlords to upgrade the energy efficiency of their rental properties.”

Ursula Hartley, director of gas research for the firm added: “The government objective for 600,000 heat pump installations/year by 2028 was already seen as ambitious by many, considering approximately 55,000 installations were made in 2022.

“The additional grant may drive some increase in the near-term but we expect the rollout to remain slow with the government target unlikely to be achieved until the 2030s.

“This delay in transition to heat pumps and the weakening of energy efficiency legislation for the rental sector will slow the reduction in residential gas demand.”

When asked about the gas demand of UK boilers, Wood Mac’s director of gas research explained: “Approximately 23 million households in the UK use a gas boiler for space heating.

“Residential gas demand in 2022 was approximately 25 bcm (approximately 35% of total UK demand).”

Predicted price decline and what’s causing it

Ahead of Sunak’s controversial green policy rollback, Wood Mac published its ‘Short-Term Outlook – Europe Gas’ report that found that the European gas sector was set to see a fall in gas demand that will have a knock-on effect on prices next year.

Factors for this included; storage reaching as high as 96% levels at the end of October and a softening of demand for gas in the power sector.

This led to a prediction that prices could fall by 20% compared to current levels, or $4 per million British thermal units (MMBtu), by next summer.

Wood Mac’s research director for European gas and LNG markets, Mauro Chavez, said on the findings: “The Norwegian maintenance schedule being extended could have had a serious impact if storage levels were not so high.”

Mr Chavez added: “And while the strikes in Australia will ripple across the global LNG market, it is more likely they will be short-lived, limiting the implications on Asian and European market balances.”

Chevron and labour unions reached an agreement to end strikes at key liquefied natural gas facilities in Australia.

This industrial action prompted spikes in prices in Europe and Asia as workers fought for a change in pay and conditions.

Wood Mac’s report forecasts a further reduction of 9 bcm (billion cubic meters) in overall gas demand in 2024, the equivalent to a 2.2% decline year-on-year.

Mr Chavez predicts: “in 2025, the European gas balance will get tighter due to Russian imports through Ukraine stopping as the transit agreement expires.”

He added: “The market anticipates a big drop in prices in 2025 on the expectations that more LNG supply will be available.

“However, we think this is overplayed as it will take time for supply to ramp up, while LNG demand in Asia will increase.”

Prime minister’s ‘historic mistake’

Rishi Sunak’s rolling back of green policy, which included pushing back the ban on the sale of cars powered by diesel and petrol by five years to 2035, prompted outrage in the energy sector.

Businesses described the call as a “historic mistake” at the time of the announcement.

ChargeUK, which represents electric vehicle (EV) charging service providers, including BP and Shell, warned jobs would be put at risk over the decision.

The Subsea trade body Global Underwater Hub (GUH) said deferring timelines “will have an impact across the board on energy security, infrastructure, manufacturing and the workforce.”

However, Rishi Sunak decried the “unacceptable costs” involved in many of net zero policies, which he said “may not be necessary” to achieve net zero.

He claimed he was “not abandoning any targets or commitments” and said that the UK had “over delivered on carbon budgets”, despite warnings from its advisors that their confidence in the UK’s ability to meet its allocations had worsened over the past year.

Recommended for you

© Shutterstock / Dmitry Naumov

© Shutterstock / Dmitry Naumov