Having secured his place as BP’s chief executive, Murray Auchincloss now has a chance to make his mark during a pivotal point in the supermajor’s evolution.

On Wednesday BP (LON:BP) confirmed that interim CEO had been formally appointed to lead the business.

Formerly its finance boss, the 53-year-old Canadian took on the interim position in the wake of Bernard Looney who resigned following a scandal over undisclosed personal relationships.

Seen by many as a continuity candidate, Mr Auchincloss main task is likely to right the BP ship following months of uncertainty and perceived underperformance.

‘He certainly has a job to do’

The announcement ends months of speculation, although Derren Nathan, head of equity research at Hargreaves Lansdown, said the early market response was “lukewarm” with BP shares down 1% in early trading on Wednesday morning.

“The shares have been drifting whilst the process to appoint a leader has continued, although this also reflects the direction of oil prices,” he said.

Stock prices somewhat bounced back by the close of play on Wednesday compared to the start of the day, however, values were still down by 0.84%. as shares traded at £4.48.

As Mr Nathan observed: “Mr Auchinloss certainly has a job to do to restore investor confidence, and close the valuation gap with arch rival Shell, and an even wider gulf with its US peers.

“Continuity of the existing strategy is no bad thing but the shape of returns from the growing focus on energy transition technologies still needs to be proved.”

‘Best possible outcome’

RBC associate director of European research Biraj Borkhataria said the move was positive for shareholders.

“In our view, this represents the best possible outcome for BP shareholders in the short term, as it represents continuity for the investment case. An external candidate would have brought further uncertainty on the direction of the business and potentially more noise around another strategy shift.

“As we have noted previously, we thought Murray was the most logical successor, given he is well known and respected by the investor community. With one overhang now removed from the investment case, we see room for BP to outperform from here on, given our belief that the current share price undervalues the business.

“Looking forward, with less focus on takeover speculation and potential strategy shifts, we believe investors should be able to focus more on the portfolio, underlying growth and potential returns over time.

However Ashley Kelty of Panmure Gordon suggested business-as-usual may not be what investors want to hear.

“[Auchincloss] had made move from CFO to run the company after Bernard Looney was forced to step aside for his failure to fully disclose his “extra-curricular” activities,” he noted.

“While the appointment of Auchinloss isn’t a huge surprise, investors will be keen to hear whether he has a vision to reinvigorate the company’s fortunes or if it’s just plus ça change.”

Share price rally

BP’s share price is likely to remain at the front of the minds of both executives and investors. As Mr Nathan noted, the valuation gap between its peers – and that between European and US energy firms more generally – will be a top priority.

Addressing the group’s Q3 results in October, Mr Auchincloss said BP’s share price multiples are trading “equivalent with our European peers”, and that it had “closed the gap” with some of its US peers by a third over the past year.

Pointing to strong EBITDA performance, he affirmed that “I think you’ll see us continue to close that share price gap,” the coming months.

Meanwhile, speculation continues as to whether BP could be part of further consolidation moves amongst US and European oil majors, though the CEO dismissed any such suggestions in October, noting that M&A “is really not on our minds if I’m honest.”

“In the short-term BP’s strong cash flows remain a key area of focus, enabling investment in future proofing the company whilst making supporting a yield of over 5%. Despite cooling energy prices that position does not look under threat,” noted Mr Nathan.

“Assuming an oil price of $60 per barrel, some way below the current price, BP should have room to continue growing the dividend, and purchase around $4bn of shares each year.”

US headwinds

Wresting control of BP’s US renewables developments is also likely to be a top priority.

The supermajor booked a $540m pre-tax impairment relating to its US offshore wind projects last quarter, blaming “inflationary pressures and permitting delays”.

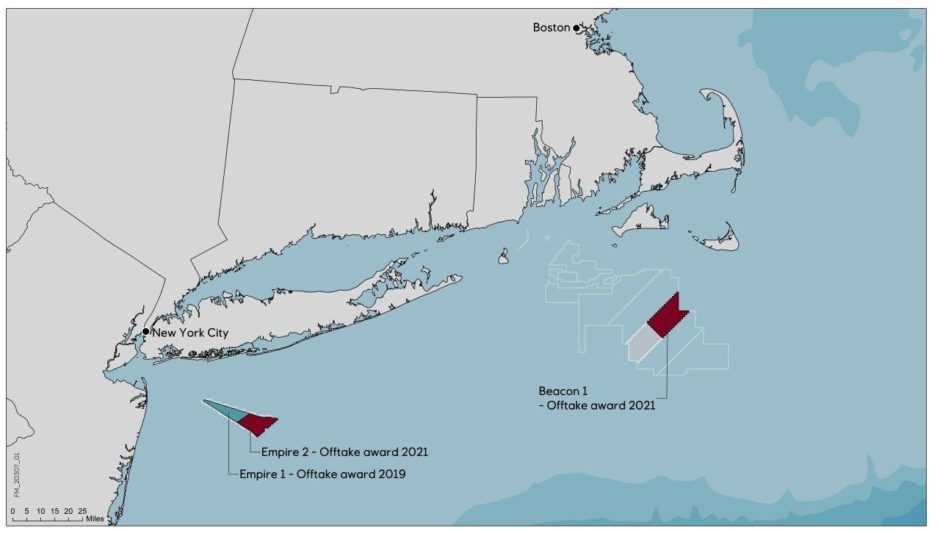

It was driven by the 3.3GW of offshore wind capacity under development by Equinor and BP off New York at the Beacon and Empire wind schemes, as part of a 50-50 partnership unveiled in 2020.

That was followed in January by the termination of an agreement with the US state. The move was billed as a “reset” decision, with the two pledging to seek “new offtake opportunities” for Empire Wind 2, south of Long Island.

Yet despite the US setbacks, the Mr Auchincloss has said BP will continue to focus on European and UK offshore wind, where it intends to pursue “integration” with its other business arms and an emphasis on ‘green electrons’ amid a larger value chain.

Pension potshots

A localised, though notable issue, could be a grassroots group of BP pensioners who have vowed to pursue legal action over the company’s decision not to grant requests for payouts from their fund.

Recipients appealed to BP’s board and chief executive last year seeking a total 9% increase to disbursements in light of rising living and energy costs. While a 5% uplift was accepted – the maximum annual increase guaranteed under the scheme’s rules – their additional 4% cost-of-living request was denied in April by then CEO Bernard Looney and the board.

Further reports emerged suggesting the £30bn fund – which pensioners maintain has a surplus of £5bn – could also be the subject of a record-breaking sell-off deal.

The group, which represents some 2,500 members of a company-backed defined benefit pension have said they will look to “escalate” legal proceedings unless they receive satisfactory answers from executives.

While the dispute is unlikely to derail the supermajors’ wider strategy, it may wish to avoid a major public spat with pensioners during an ongoing cost-of-living crisis.

Reputational risk

Finally Mr Auchincloss will also have the wider task of restoring some of the credibility lost in the wake of the scandalous departure of his predecessor.

The company made clear its hard line on the matter, with Mr Looney forfeiting more than £32m in share, salary and bonus payments in the wake of an internal investigation – even briefing executives on why the measures were not “unduly harsh”.

But beyond misconduct, the findings of that investigation were not made public- and any further disclosure is seen as unlikely, beyond more general “themes and lessons” learned from the process.

Mr Looney was the third of four recent BP CEOs to step down in scandal after Tony Hayward bowed to pressure in 2010 over his handling of the Deepwater Horizon blowout and John Browne exited in 2007 after lying to a court about a relationship.

Much therefore rests on Mr Auchincloss to prove the 114-year-old company has not lost its judgement.

BP will release its Q4 and full year results on 6 February.

Recommended for you

© Supplied by Equinor

© Supplied by Equinor