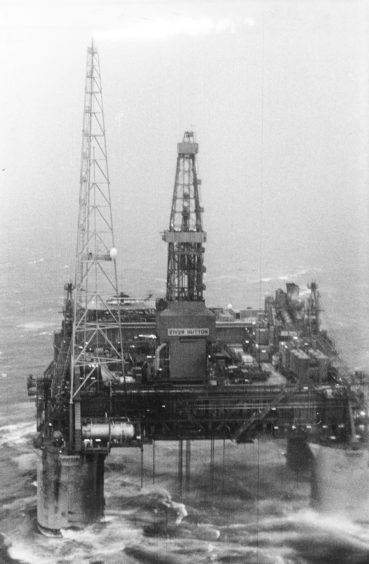

Ping Petroleum has picked up a trio of North Sea licences, including that pertaining to the slumbering Hutton field.

Hutton was discovered in 1973 and produced oil through the 1980s and 1990s before it was shut in in 2001.

Bridge Petroleum most recently held the licence for North West Hutton, which it renamed Galapagos, which stands around 80 miles east of Shetland in the northern North Sea.

Galapagos sits in an adjacent licence to the Hutton field with the two coming under P2625 and P2626 respectively.

“Revitalising” the historic Hutton field is on Ping’s list of priorities, however, this task is not without its challenges.

Ping Petroleum’s managing director Zainal Abidin Jalil said: “Hutton provides a different challenge for us as it is located in deeper water and a harsher environment.

“Further subsurface work needs to be completed prior to a high-level recovery concept being put forward.

“This provides an excellent opportunity for Ping to find an innovative and environmentally cognisant solution to extract remaining value from the field.”

In addition to the Hutton licence, Ping Petroleum picked up ownership of the Glenn field and completed its farm-out deal relating to the Pilot field.

Ping will now own a controlling 81.25% interest in licence P2244, which contains the Pilot field, while Orcadian Energy retains the remaining 18.75% stake.

Last year when the deal was announced Orcadian valued of the sale of Ping’s stake at $3.1 million, though that also included the payment of historic costs incurred by the company to date.

Ping will then pay the $3m balance following the regulator’s approval of a field development plan (FDP) for the field and will also have to foot the bill for all pre-first oil scope of work.

Mr Jalil added: “Orcadian Energy, with support from TGS, has worked the subsurface of this area for several years. We believe some simplification of the development concept and a phased approach can provide an economical solution.

“Glenn, which is currently a stranded asset, offers a chance to add value to our Avalon development by adding another reservoir. This enables us to continue our strategic focus of MER [maximum efficient rate].”

First oil ‘soon after the projected end’ of EPL

The company now plans to set out on subsurface and engineering studies to assess the best development concepts for these projects while sticking to its energy transition goals.

Both of these developments are in the Central North Sea where Ping has experience in operating Anasuria and progressing their greenfield development, Avalon and partnering on Fyne.

Mr Jalil commented: “We are very excited about these licences and we believe we can use our technical skills from across our expert teams based in Aberdeen and Kuala Lumpur to extract significant value at low cost and very low emissions.

“These licences are likely to present technical obstacles which we are looking forward to tackling. In addition, the commercial challenges also have to be considered. Ping is the right kind of operator to find suitable solutions to both.

“We anticipate these projects will potentially come to first oil soon after the projected end of the Energy Profits Levy (EPL).”

© Unknwon

© Unknwon © Ping Petroleum

© Ping Petroleum