Plans to reduce pollution emitted on the proposed Rosebank field in the North Sea are more challenging due to Labour’s tax policies.

This is the warning from Equinor (OSLO: EQNR) boss Anders Opedal. Equinor is the operator and majority shareholder in the largest untapped oilfield in UK waters which has become a major battle front in the future of the North Sea.

Having won a thumping majority in the UK elections, the new UK government is pressing ahead with its energy policies announced in the run up to the vote.

Labour plans includes plans to extend and increase the headline rate of tax on North Sea operators to 78% while removing incentives for investment.

The Labour party has also affirmed commitment to banning the issue of new oil and gas licences but this is thought not to include Rosebank which was granted consent by the North Sea Transition Authority (NSTA) in September.

But there are fears that Government policies could make it more difficult to make oil and gas production cleaner. At stake is to how feasible the UK tax regime makes investment, such as by Equinor and its partners, in electrifying oil and gas production which reduces the amount of pollution emitted in the process.

The Rosebank field development plan was approved in compliance with the North Sea Transition Deal that it promised delivering oil and gas with the “lowest emissions possible”.

The plan continues…but

Speaking to the Financial Times, Opedal said: “The plan is to continue with electrification…but it has been more challenging now than it was due to changes in the fiscal regime over time.”

He added: “All large energy projects are big and long term investments and predictability and stable fiscal regimes are important.”

However he warned that “decision makers understand that changes introduce some new risk and we need to fully understand the risk before we are able to say how we are progressing.”

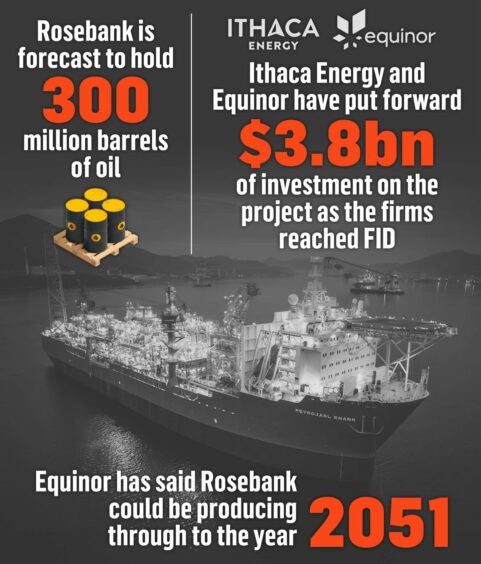

The $3.8 billion Rosebank project, of which Ithaca Energy (LON: ITH) owns 20%, is set to come on stream in 2026-2027, Equinor has said.

The company plans to invest some £10 billion in the UK by 2030 across oil, gas, renewables and other energy related projects, the firm said.

Recommended for you

© Supplied by Roddie Reid/ DCT

© Supplied by Roddie Reid/ DCT