Gas firm EnergyPathways (AIM:EPP) has shared its support for last week’s changes to the energy profits levy which prompted outrage from some of its peers.

The business focussed on the fact that the energy profits levy’s (EPL) decarbonisation investment allowance will be retained.

It said that this is a “positive indication of the new Labour government’s commitment to support investment in energy transition projects.”

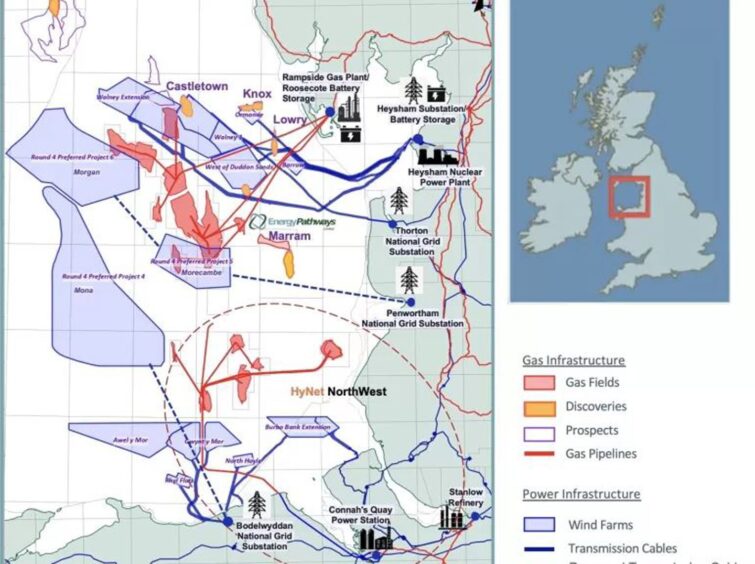

Projects such as EnergyPathways’ Marram Energy Storage Hub (MESH), located in the Irish Sea, will provide long term clean energy supply and storage and will be completely powered with UK renewable energy and stand to benefit from the decarbonisation investment allowance.

MESH is a gas and hydrogen storage facility which is set to come from the Marram gas field.

EnergyPathways said: “Once operational, MESH will produce the low emission natural gas contained within the Marram gas field to displace the UK’s high emission LNG imports, which are estimated to have a carbon footprint intensity ten times greater than MESH supply.”

The Decarbonisation Investment Allowance, set at 80%, incentivises decarbonisation in the UK’s energy sector.

This covers electrification, powering production facilities with renewable energy, green hydrogen production and reducing greenhouse gas emissions.

Ben Clube, CEO of EnergyPathways commented: “The new changes to the EPL are in line with our expectations and are aligned with our strategy that positions EnergyPathways to pursue energy storage opportunities such as the Marram Energy Storage Hub, or MESH, which will be critical to the UK meeting its energy security and net zero goals.”

‘Companies like Serica won’t invest’

This comes soon after Serica Energy’s chairman took to the airwaves to explain that firms like his will stop investing in the UK if Labour makes the wrong moves on the EPL in its first budget.

The Labour government announced plans to up the rate oil firms pay under the energy profits levy and the move to abolish investment allowances under the fiscal policy.

The headline rate of tax imposed on oil firms will now be 78%.

Serica chairman David Latin said on Monday: “The real issue, actually, concerns the uncertainty around capital allowances going forward where significant reductions could be announced with the October budget but we’re left not knowing how big those may or may not be.”

Last week’s government announcement outlined that “there are no plans to change the availability of capital allowances in the permanent regime.”

However, capital allowances will be under review in the upcoming budget as the chancellor has the option of changing how much is available for oil firms in the North Sea.

Latin said: “Capital allowances mean that businesses can offset investments against tax and if the ability to do this is reduced then companies like Serica won’t invest.”

He warned that without these allowances North Sea oil and gas production which he said is “declining anyway” will “fall off much more rapidly and fields will close much earlier.”