© Shutterstock Feed

© Shutterstock Feed Hopes the Labour government will fund its ambitions to turn the UK into a “clean energy superpower” through taxing the oil and gas industry have been cast into doubt as new figures show money raised from the Energy Profit Levy has been flat and may yet shrink.

The levy, dubbed the windfall tax as it was brought in by the prior Conservative government when oil and gas profits were high, is set to be raised and extended in the Labour government’s budget in October.

Chancellor Rachel Reeves is also aiming to remove investment incentives in a move that industry analysts have warned will render the North Sea industry “fatally wounded in less than five years”.

Data report

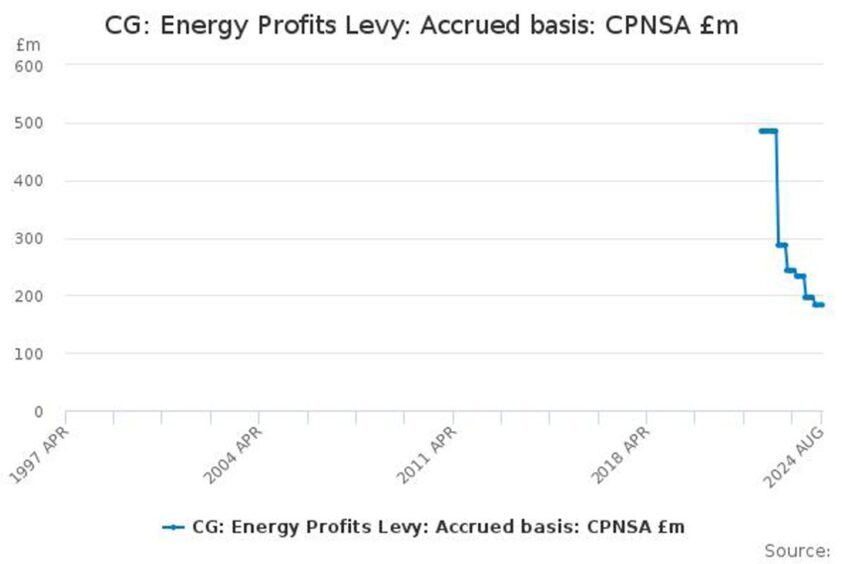

The Office of National Statistics published the latest EPL data which showed a drop from 1,880 in Jan-Jul 2023 to 1,333 in Jan-Jul 2024.

According to business and tax advisers RSM UK, the figures highlight a steady downward annual trend of revenues since the windfall tax was introduced in 2022.

Sheena McGuinness, head of renewables and cleantech RSM, said windfall tax revenues have been on a “steady decline since its inception” with the most recent figures showing a 29% drop between the same period in 2023.

“The historical trends support concerns about the shrinking tax base and cast further doubt on the assertion of a £1.2bn per annum uplift in windfall tax revenues which the government have ear marked to fund GB Energy.

“If plans to extend and increase the Energy Profit Levy to 38% are brought in by the government, we might see a short-term increase in revenues, but the impact on future investment and behavioural shift could result in further corrosion of the tax base, in turn, revenues.

“Unless the return on capital from GB Energy outperforms the private sector early stage returns in the renewables sector, any changes to the windfall tax now may exacerbate the budgetary deficit with increased borrowing likely to fund any shortfall.”

Mike Tholen, sustainability and policy director at trade body Offshore Energies UK (OEUK), said the fall in revenues for the tax man reflected a decline in investment that has been made worse by high taxes.

He said: “There has been a rapid decline in production due to under investment over this decade and time is running out to mitigate damage that has already been done to the offshore energy industry. For more than two years UK oil and gas operators have paid three times the rate of corporation tax of any other sector in the economy.”

But he held out hope that a new industrial strategy, the launch of which was confirmed by Reeves in her speech at the Labour Party Conference in Liverpool, would support the sector’s ambitions.

He said: “However, with an industrial strategy built in partnership with government, the UK can leverage the strengths of its offshore energy industry, put homegrown innovation and technology at the heart of its net zero ambitions, and ensure the UK is globally attractive for energy investment.”

Aberdeen and Grampian Chamber of Commerce (AGCC) chief executive Russell Borthwick said the figures meant the Treasury needed to maintain allowances in an effort to prevent “severe” consequences for the industry and the region.

“Industry, academics, unions and tax experts are now completely aligned in warning that increasing the windfall tax will be a disaster for the North Sea, for workers and for the British economy,” he said.

“The Energy Profits Levy, and the recently-announced increase and extension thereof, is having a chilling effect on the sector. Unless steps are taken in the Budget to address this, then the damaging consequences in terms of future investment activity, employment and the economic future of the north-east Scotland region could be severe.

“The Energy Profits Levy is currently the only windfall tax on any sector, anywhere in the world. On the basis that windfall conditions no longer exist and market prices for oil and gas have returned to ordinary levels, Treasury should maintain allowances within the current oil and gas fiscal regime and work towards the swift removal of the EPL entirely.”