Offshore drilling firms are ready to turn their backs on Aberdeen after George Osborne’s new tax raid on the oil and gas industry.

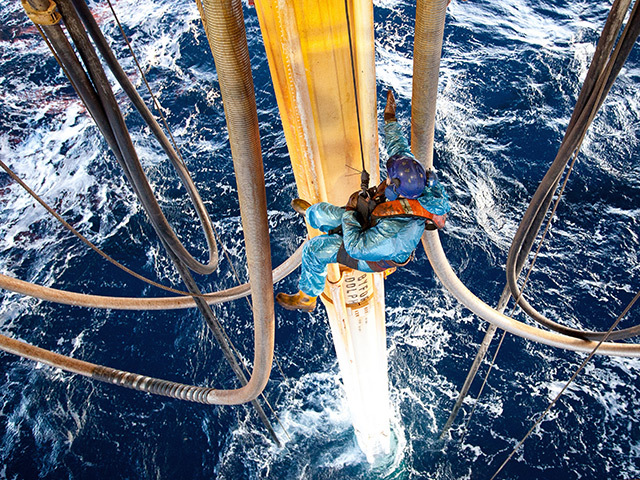

The chancellor is facing mounting pressure over his decision to slap an extra tax on rigs and flotels coming into the North Sea to carry out work – a practice known as bareboat chartering.

The UK is already in the midst of an “exploration crisis” and industry chiefs have been trying to trigger a new wave of drilling to secure reserves for the future.

But last night the body that represents drilling contractors said some rigs operating in the UK would now be withdrawn and redeployed to regions with a more favourable tax rate.

The International Association of Drilling Contractors (IADC) also warned firms with headquarters in Aberdeen could pull out of the country altogether because of the “fiscal instability”.

Its concerns were echoed yesterday by the boss of oil and gas giant GDF Suez, which fears costs will be passed on to operators.

IADC executive vice-president Taf Powell said its members were “deeply disappointed” by the decision

“We believe this is not sustainable to our industry and will cause the UK offshore sector to shrink,” he said. “Overall we think the costs to the UK economy will be higher than the immediate extra tax revenues forecast by these measure.

“The tax-raising measures invalidate existing pricing agreements, and the additional costs will render some UK projects uneconomic.

“In addition, where the additional costs cannot be passed on to the client, rigs may be withdrawn from the UK, and new North Sea-class rigs intended for the (UK Continental Shelf) will be diverted to countries where economic returns are more predictable.”

He added: “Drilling rigs are inherently mobile – and drilling contractors are inherently international. Drilling companies, many of them having recently installed their headquarters in the UK, are now considering their options due to this latest example of fiscal instability.”

Colin Pearson, a tax partner at EY in Aberdeen, said the loss of just one new development would outweigh the extra tax raised from the bareboat measure. “As rig owners increase the price of hiring their assets, exploration could decrease, leaving us with a scenario that sees a drop-off in the number of new developments,” he said.

Rob Buchan, Aberdeen general manager of GDF Suez E&P UK, said operators were worried the extra costs would be passed on to them.

He added: “We have rigs on 18-month contracts. Those contracts have more or less just started, so those rigs were contracted on historical day rates, negotiated two years ago, for example, and if those rates were to change today, then all of the economics around the programme would have to be revisited.”

Chief Treasury Secretary Danny Alexander has defended the new tax raid on the North Sea – insisting any anger about it was “dwarfed” by the industry’s enthusiasm for the wider Budget changes.

Chief Treasury Secretary Danny Alexander has defended the new tax raid on the North Sea – insisting any anger about it was “dwarfed” by the industry’s enthusiasm for the wider Budget changes.

The Highland MP admitted there was “frustration” in the sector that the Treasury was pressing forward with an extra tax on rigs, expected to cost offshore firms about £1billion.

However, the Liberal Democrat said companies based overseas were making “very substantial profits” from North Sea operations but were not paying appropriate tax rates in Britain.

Mr Alexander was criticised in 2011 when it emerged that a shock £10billion Budget tax grab on producers, which almost wiped out new offshore investment at a stroke, was his idea.

“We’ve spent a lot of time discussing this with the industry,” he said.

“As a consequence of that we’ve made a few changes to what was proposed.

“We’ve narrowed the scope of it, so it will no longer apply to FPSOs (floating platforms), and it will no longer apply to seismic vessels, and the cost allowance that you can offset against it has been increased.

“The basic point of the measure is to say that there are, in that remaining narrower category, very substantial profits being made.

“When those vessels are domiciled overseas in the Caribbean or wherever, then all of those profits are simply being ‘offshored’, and we think it’s appropriate that, as we say to companies in every other sector that are operating in the UK, that you should pay tax in the UK.”

The Budget also included plans for review of all North Sea taxes, which Mr Alexander said was widely supported, as well as new allowances for high pressure and temperature fields.

“With these big new-field allowances, the work we’ve done very well with the industry on the Wood Review, this new review of the fiscal framework in the North Sea – which is an opportunity to look at everything about the way that the North Sea is taxed, I think particularly to try and simplify the system – the reaction I’ve had from the industry is that this is an excellent package for the industry.

“You are right that there may be some frustration about that one specific measure, but it’s dwarfed by the overall benefits of the package.”

Recommended for you