Confidence among North Sea oil and gas operators and the wider supply chain has hit a new low, according to a survey.

The results have prompted Aberdeen and Grampian Chamber of Commerce (AGCC) to propose a five point plan to Chancellor Rachel Reeves as she prepares the new UK government’s budget at the end of the month.

AGCC chief executive Russell Borthwick said the Energy Profits Levy (EPL), and the UK government’s plans to increase and extend it, are having “a chilling effect on the sector”.

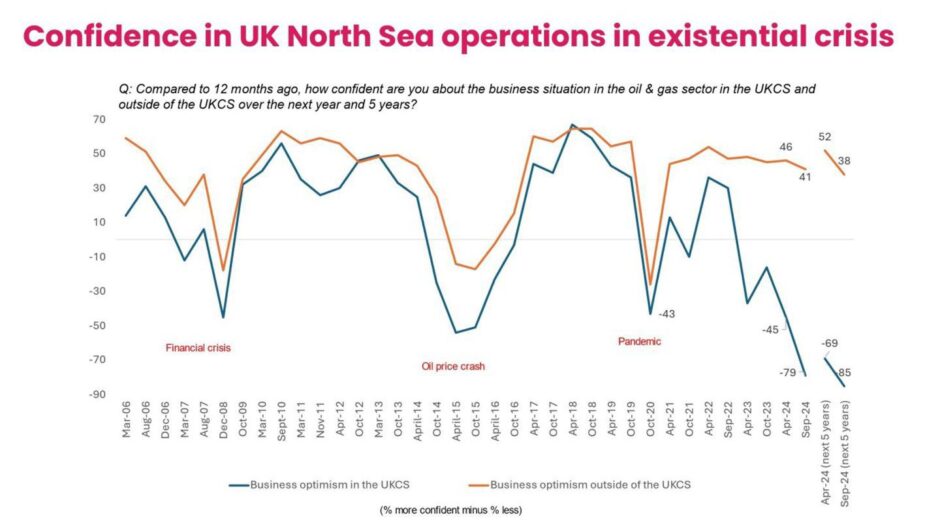

The latest survey data comes from the chamber’s 40th Energy Transition Survey which shows that confidence in the North Sea over the next one to five years is at an all-time low, far worse than at any point during the financial crisis, oil price crash or during the Covid-19 pandemic.

The chamber released the data ahead of the planned publication of the full report, due 7th November, critically after the 30 October budget day.

The online survey was live between August 29th to September 24th 2024 with 111 businesses, including seven operators and 104 contractors and service companies that collectively employ over 46,000 people in the UK, completed the survey.

Prior to the General Election, AGCC warned that the new government had 100 days to save 100,000 jobs by restoring confidence among investors in the UK oil and gas industry but since that deadline passed, the research “shows a sector in crisis”.

Borthwick said: “Unless steps are taken in the budget to address this, then the damaging consequences in terms of future investment activity, employment and the economic future of the north-east Scotland region could be severe,” he said.

“You do not fix a grave economic situation by putting tens of thousands of people out of work, which is looking increasingly like the outcome we face after October 30.

“The Energy Profits Levy appears to be the only ‘windfall tax’ on any sector, anywhere in the world. On the basis that windfall conditions no longer exist and market prices for oil and gas have returned to ordinary levels, Treasury should maintain allowances within the current oil and gas fiscal regime and work towards the swift removal of the EPL entirely.”

Industry body OEUK has forecast that 35,000 direct jobs could go if the UK Government proceeds as planned. Investment bank Stifel believes this figure could hit 100,000 in working communities across the UK when all jobs supported by the oil and gas industry are considered.

AGCC proposal:

Remove the EPL by the end of 2025

AGCC said: “The Government could restore confidence in the UKCS by reinstating the original sunset clause applied to the Energy Profits Levy, removing the tax altogether after 31 December 2025. This would reflect the reality that windfall conditions no longer exist and give much-needed certainty to the sector.”

Resist further increases to the EPL

AGCC said: “Failing removal of the Energy Profits Levy altogether by the end of 2025, the Government should not implement plans to increase the tax to 38% from 1 November 2024. Doing so will result in a loss in economic value of around £13 billion, compared to the economic contribution generated under the current windfall tax regime, according to modelling undertaken by OEUK.”

Early implementation of a progressive successor regime to the EPL

AGCC said: “Government should work with industry to devise a new progressive tax regime for the North Sea: one where the tax rate increases as oil and gas prices rise and reduces when prices fall. This framework should operate in a predictable way which allows the sector to make investment plans for the future. This successor regime cannot wait until beyond 2030, when much damage will have been done to our domestic energy industry and its workforce. It should be pursued immediately.”

Set a binding sunset clause for the EPL

AGCC said: “If Government is unwilling to pursue options 1 and 3, then it should legislate a binding sunset clause for the Energy Profits Levy of 31 March 2030 or earlier and announce a legislative timeline for implementation of the successor regime that applies to the upstream oil and gas sector beyond that date, with a headline rate of no more than 40%.”

Capital allowances: full expensing at 78%

AGCC said: “In just over two weeks we’ll find out if the Government has been listening to the trade unions, businesses, investors and academics or whether it chooses to extend and increase the Energy Profits Levy. Even if it does so, the principle of full expensing must at least be maintained, given the central role that the North Sea energy sector plays in delivering energy security and investing in the transition. Failure to protect this would place the sector at a comparative disadvantage to other sectors and hinder the UK’s net zero ambitions.”

Recommended for you

© Supplied by AGCC

© Supplied by AGCC © Supplied by AGCC

© Supplied by AGCC