Chief Secretary to the Treasury Danny Alexander yesterday further defended the government’s “oil exploration tax”, claiming profitable companies operating in the North Sea needed to pay a fair amount of tax.

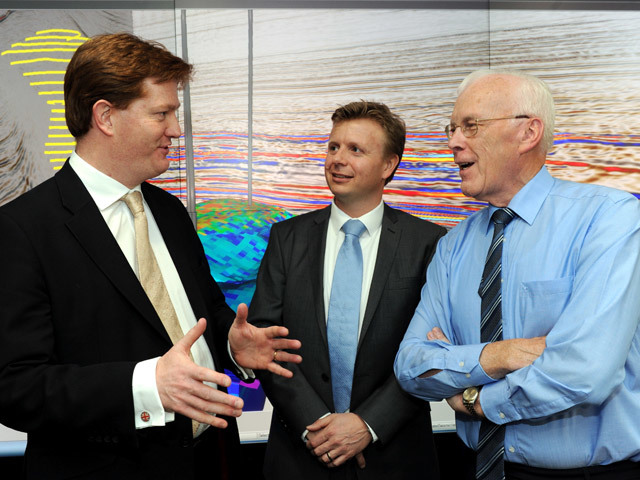

The MP for Inverness was invited to open the recently-completed Aberdeen offices of Maersk Oil, which has confirmed it will press ahead with a £1billion investment in the Central North Sea thanks to support for field development laid out in Wednesday’s Budget.

But the senior industry figures who attended the event in Aberdeen yesterday also expressed their dismay over the so-called bareboat chartering tax, which is expected to cost the industry £1billion over the next year.

Sir Ian Wood, author of the report on maximising North Sea potential, said the tax was “regrettable”. Professor Alex Kemp of the University of Aberdeen said it was “unfortunate”. Martin Rune Pedersen, managing director at Maersk Oil UK and host of the event, said the move unveiled by the Chancellor George Osborne in his Budget was “unwelcome”.

But the industry trio were also highly enthusiastic about the government’s tax breaks for so called “ultra-high-pressure high-temperature” (uHP/HT) fields, as well as its confirmation that recommendations made in Sir Ian’s report, including the establishment of an industry regulator, would be in place quickly.

Mr Alexander insisted this week’s budget was “hugely positive overall for the North Sea”.

“The new high pressure high temperature allowance is opening up a huge amount of investment in new developments. It is also important we have a fair tax regime, that the companies who are making significant profits do pay a proper amount of tax. That is what we have been seeking in relation to the rig hire companies.

“Getting the balance right between having a fair tax system and one that incentivises development is what we seek to do with this Budget.”

Mr Pedersen confirmed that the new uHP/HT was an “enabler” for the firm’s £1billion Culzean gas discovery which it intends develop this year.

“It is what we believe is required to ensure we can keep up the pace of progress of the development.”

Watch our video interviews with Danny Alexander, Martin Rune Pedersen, Professor Alex Kemp and Sir Ian Wood below

But he added that rising costs remained a big challenge for the industry.

“[The bareboat tax] was an unwelcome event but I also noticed the government has committed to come back in year’s time to review the impacts and potentially look at the measure again.”

Sir Ian Wood yesterday welcomed a shift in tone in the relations between the North Sea industry and the government in the latest Budget.

Speaking at the launch of Maersk Oil UK’s new Aberdeen headquarters in Altens, Sir Ian said: “It is talking about consultation and the importance of collaboration.

“It is talking about the new regulator.

“It is looking at exploration and the cost of decommissioning – it is very encouraging.

“It is the tone of the Budget as well as what it says that is important.”

But his views on the rig tax introduced tempered his pleasure.

“The thing about bareboat is the impact on exploration.

“We absolutely need something to revitalise exploration, it is at an incredibly low level and exploration is the seedcorn of the future.

“I think that is regrettable, but overall the Budget is generally very positive.

“I recognise it is not helpful for exploration, but in an overall context we have a Treasury that is saying we are prepared to work much more closely with the industry and we are prepared to listen to the regulator – that is all good news.”

Professor Alex Kemp of the University of Aberdeen said the government’s “ultra high pressure high temperature” allowance was “economically very sensible”.

He said the measure was also unusual for North Sea tax breaks in that it would allow associated and linked fields to be included in the reliefs.

“Up until now, with the various field allowances we have had, the relief has related strictly to investment in the identified field.

“I see in the Budget proposal the intention is to extend this to exploration in related areas.

“The details will have to be worked out, but the concept of allowing exploration to be included for the allowance is very interesting and could be very rewarding.”

Recommended for you