The banking and energy sectors will be back in the firing line next week when major players including Centrica and Barclays report half-year results.

Three of Britain’s “big four” banks will continue to be haunted by past misconduct issues when they deliver interim results over the coming week.

Barclays, Lloyds and Royal Bank of Scotland are expected to set aside another £1billion towards compensating customers mis-sold products such as payment protection insurance (PPI), while Lloyds is also set to join the other two banks in agreeing a settlement over the rigging of Libor rates.

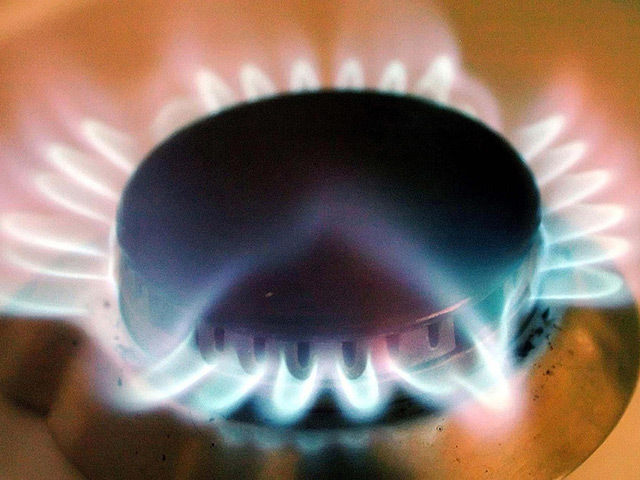

Meanwhile, British Gas owner Centrica is expected to reveal a sharp fall in profits when it publishes half-year results on Thursday.

It is also set to name a successor to boss Sam Laidlaw after admitting that it was in talks with BP’s Iain Conn, who has announced his intention to leave the oil giant after 29 years service.

Analysts have pencilled in a 32% fall in adjusted operating profit to £1.08billion with earnings becalmed by a mild winter in Britain but also buffeted by a freeze hitting its business in America.

Centrica has said it will leave UK tariffs unchanged this year despite the squeeze on its bottom line.

But it is under pressure to cut them after Ofgem last month called on suppliers to set out how they planned to pass on falling wholesale gas and electricity prices to households.

Interim results are expected to show profits from residential energy supply in the UK around 24% lower at £270million while Centrica’s “downstream“ customer-facing business in the US is predicted to see a 61% fall to £65million.

The latter is the result of its North America business facing additional charges to pay for more energy to meet customer demand during harsh winter weather.

Analysts are also predicting large falls in the group’s “upstream” operations including gas and oil production and power generation, as well as in UK storage.

The figures come a month after the British energy market was formally referred by Ofgem for a probe by the Competition and Markets Authority that will last 18 months.

Centrica is seen as vulnerable to being broken up as a result of the investigation because, through former nationalised supplier British Gas, it has nearly 40% of the gas retail market.

Ofgem has said soaring household bills and intensifying public distrust highlighted the need for an investigation, amid concerns that not enough consumers were switching supplier and the vulnerable were being ripped off.

But Centrica said the probe could create uncertainty and threaten the billions of pounds of investment needed to keep the lights on.

Analysts at UBS said: “We see UK political risk perceptions increasing through to at least the September political party conferences, as Labour renew their attacks on the energy retailers ahead of the May 2015 election.”

Recommended for you