Singapore’s Dart Energy said yesterday its shareholders had approved the company’s takeover by UK rival Igas.

An all-share deal announced in May valued Dart at £117million.

It will create the UK’s largest shale gas explorer and see Dart shareholders take a 30.5% stake in the enlarged IGas company.

But it remains subject to three further conditions, including approval by the UK Competition and Markets Authority as well as regulatory bodies in Australia.

Consent has already been obtained from the UK Department of Energy and Climate Change.

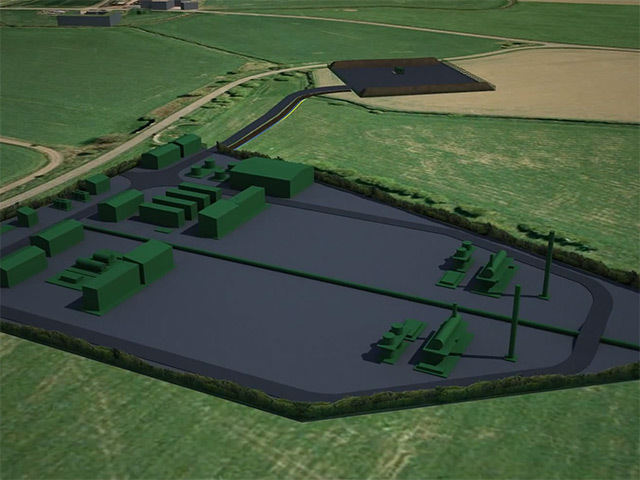

Dart is focused on the unconventional gas industry – the extraction of natural gas from coal beds and shale.

It has assets in Europe, including four coal bed methane licences in Scotland, as well as Asia and Australia.

London-based IGas is one of the leading producers of onshore hydrocarbons in the UK.

Taking over Dart will give it access to more than 1million acres of licensed land in the UK, allowing it to drill for oil and gas.

The acquisition is expected to complete on October 1.

Recommended for you