Wrapping up a $7.6billion acquisition is satisfying for any executive. Outmanoeuvering your former boss to do so is even better.

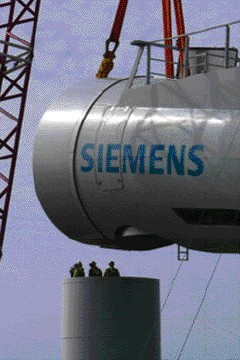

Siemens AG Chief Executive Officer Joe Kaeser did just that in a deal to buy Dresser-Rand Group Inc., a US oil-and-gas equipment specialist. Also bidding for the company was Swiss pumpmaker Sulzer AG, where former Siemens chief Peter Loescher is now chairman.

Loescher “worked for Siemens, and I can well imagine that the attractiveness of Dresser-Rand was known to him,” Kaeser told journalists on a conference call on Monday.

Loescher was forced out in August, 2013, after cutting his earnings forecasts for Europe’s largest engineering company five times in six years. The acquisition will give Siemens a stronger foothold in the US natural-gas industry. Kaeser has said the company must move faster to capitalize on the US boom in gas extraction from hydraulic fracturing, or fracking.

A proposed merger between Dresser-Rand and Sulzer would have combined the US company’s compressors and turbines with Swiss industrial pumps to serve oil and gas customers. And it could have been seen as a vindication of Loescher’s strategic vision even as Kaeser unravels his predecessor’s strategy.

Sulzer shares traded 0.2% higher at 122.8 francs in Zurich as of 10:25 a.m., ending a three-day losing streak. Siemens declined 0.9 percent to 93.45 euros in Frankfurt.

Loescher had sought to define the German engineering giant — which makes products ranging from trains and gas turbines to medical scanners — as both a green energy specialist and the solutions provider for big cities. In contrast, Kaeser has declared the 167-year-old company’s main business as electrification: supplying technology to generate, transmit, and efficiently use power in factories and buildings.

Kaeser has been keen to stress that his strategy would preserve Siemens’ heritage. In contrast to Loescher, a veteran of drugmaker Merck & Co. who was Siemens’ first outside CEO, Kaeser is the consummate Siemens insider. The 57-year-old has worked at the Munich-based company for 34 years, seven of those as chief financial officer.

When Loescher was pushed out of Siemens, he was given a list of competitors he was forbidden from joining, according to someone familiar with the accord. Siemens failed to include Sulzer on the non-compete list, the person said.

A representative for Siemens declined to comment on the difference between the two executives and whether Loescher was given a list of rivals he couldn’t join. A Sulzer spokeswoman declined to make Loescher available for an interview.

Since health care has few strategic ties to the electrification push, Kaeser has deemphasized that business, which had been expanded with acquisitions under Loescher. Kaeser says he will spin off a hearing-aid unit and he’s splitting the remaining health-care operations into a separate business internally.

Loescher was brought in to Siemens after a corruption scandal in 2006 that triggered investigations in at least a dozen countries, culminating in payments of $1.6billion to settle probes in the US and Germany. While Loescher gained plaudits for ending the graft, he presided over a failed push into solar energy that led to spiraling costs and he had to write down the value of several acquisitions.

Though Kaeser has had his setbacks — he failed to thwart General Electric’s acquisition of the gas turbine business of Alstom SA — Dresser-Rand is his second $1billion-plus deal this year. In May, he agreed to spend $1.3billion for most of Rolls-Royce Holdings Plc’s energy business, which also makes gas turbines and compressors. In a July interview, Kaeser said he has “firepower” for takeovers.

The Dresser-Rand deal is Siemens’ biggest since Loescher’s acquisition of health-care diagnostics specialist Dade Behring in 2007. That takeover turned sour, culminating in a 1.4 billion-euro impairment charge in 2010 after failing to meet growth targets.

While Loescher tried to compete with his former employer, the difference in size and financial firepower made it an uneven fight. Sulzer has a market capitalization of $4.3billion — less than 5 percent of Siemens’ $107billion valuation — and the Swiss company could only offer to merge with Dresser-Rand while the German rival made an all-cash offer.

“It’s always hard for management to justify accepting a merger over a cash offer to shareholders,” said Guenther Hollfelder, an analyst at Baader Bank in Munich who recommends buying Siemens stock. “In this way, shareholders get a relatively quick return on investment.”

Recommended for you