The IGas takeover of Dart Energy has entered the home stretch.

The deal, valued at £117million, is one step closer to completion after the pair formally waived their CMA condition – the approval of the UK Competition and Markets Authority.

The takeover, which will create the UK’s largest gas explorer, now awaits the final approval from the Supreme Court of Queensland.

Following court approval, DART will suspend trading its shares on the ASX on Wednesday, October 1. The new IGas shares are expected to hit the market on Friday, October 17.

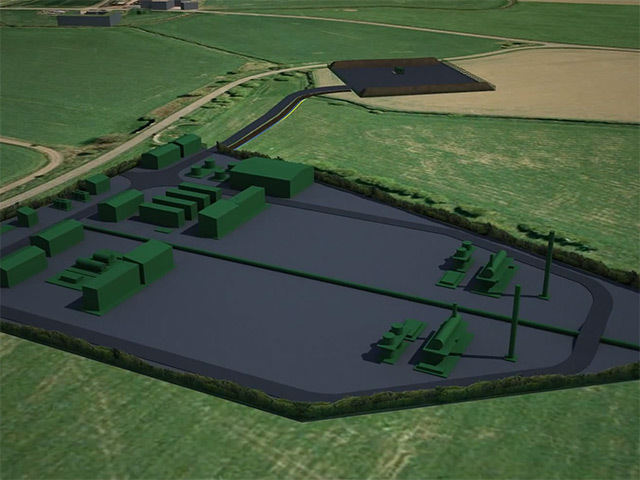

Dart is focused on the unconventional gas industry – the extraction of natural gas from coal beds and shale.

It has assets in Europe, including four coal bed methane licences in Scotland, as well as Asia and Australia.

London-based IGas is one of the leading producers of onshore hydrocarbons in the UK.