Oil giant BP is planning at least one more development phase for the huge west of Shetland Clair field at a likely cost in the range £6.3billion-£9.4billion.

No clear time-scale for development has been set – it is is at the concept stage just now – but the current expectation is that phase three of Clair will up and running before the original first stage peters out by around 2028.

The cost estimate is two to three times higher than the current phase two – Clair Ridge – development, where production is expected to start in 2016.

This is in part because it will be much harder to get the oil out of the target rocks, compared with phases one and two.

BP revealed details about the development’s third phase at the offshore industry’s Pilot share fair, organised by trade body Oil and Gas UK, in Aberdeen yesterday.

It is a welcome boost for the north and north-east energy sector at a time when it is under massive and growing pressure because of falling oil prices, advancing maturity and a huge tax burden, which may be about to be lightened as a result of the UK Government’s oil and gas fiscal review.

BP’s latest plans also come just weeks after one of Clair’s partners, ConocoPhillips, put its 24% stake in the development up for sale.

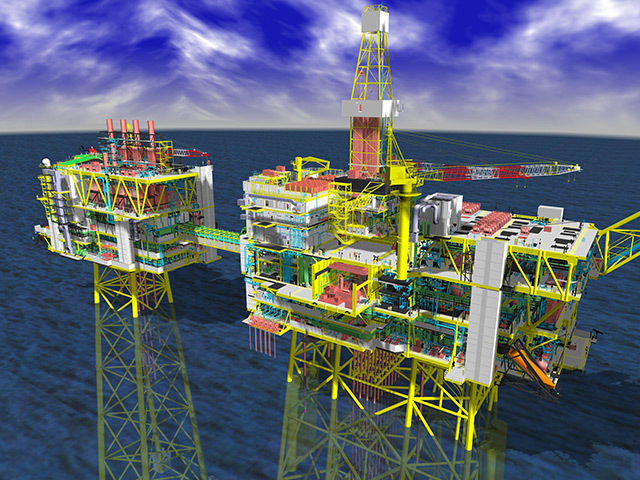

The phase three project is almost certain to require a further platform – possibly of jack-up type – to accommodate the additional processing facilities that would be required, and perhaps a drilling rig as well.

Presenting to groups of supply chain delegates throughout yesterday, Aberdeen-based project staff at BP said the new platform is likely have a topsides weight of 14,000-18,000 tonnes.

If a drilling package is included, a further 5,000 tonnes could be added to the structure.

Delegates were also told that the likely processing capacity would be in the range 60,000 to 100,000 barrels of oil per day and that around 50 wells, including multilaterals (boreholes with multiple branches) would be drilled.

The hope is that the total well count can be contained at this level by making significant use of downhole technologies, rather than drill as many as 80 more conventional horizontal wells.

The Clair team is also examining the idea of making use of what are called “well towers” to make it easier to service development wells later on.

BP said the idea of using a jack-up and subsea towers was technologically challenging for now because of the considerable water depth, but good access to production wells would be an important factor in any decision-making.

The company aims to complete the current six-well appraisal drilling campaign on Clair early next year.

Five wells have been drilled so far, with variable results. However, rumours are rife that the fifth well- only recently completed – may have been a considerable success.

The target resources lie on the south, south-west and northern portions of the giant Clair field, where current estimate for in-place reserves is around 8billion barrels of heavy oil.

Clair was discovered in the late 1970s, but it was not until 2005 that it was brought onstream because of the field’s location and geological complexity.

Recommended for you