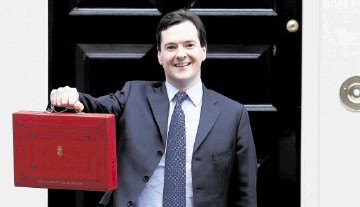

Fresh measures to shore up the Scottish oil industry in the wake of tumbling prices are set to be announced in the Budget, George Osborne has indicated.

Analysis by the respected Institute for Fiscal Studies (IFS) that suggests an independent Scotland could have been up to £7 billion worse off as a result of falling oil revenue “reminds everyone of the risk of independence”, the Chancellor said.

Mr Osborne lambasted predictions made by the SNP during the referendum campaign about the finances North Sea oil would generate for the nation as “wildly optimistic”.

He told the Commons Treasury select committee: “I took decisions in the Autumn Statement to reduce taxes on North Sea oil, anticipating the pressures that the falling oil price would have on the industry and I’m sure we are going to have to take further steps at the Budget.

“But we can only do that because we are United Kingdom and we pool our risks.”

The energy industry is suffering a wave of job losses as oil prices continue to plummet amid increasing US production and falling demand in economically struggling countries.

Schlumberger, the world’s largest oil and gas services group, last week confirmed that North Sea jobs would be lost as part of its plans to cut 9,000 posts internationally – a move which followed 300 job cuts announced by BP.

Mr Osborne said that while UK economic forecasts were made by the independent Office for Budget Responsibility, Scotland’s predictions were made by its government.

He added: “From memory, the Scottish government forecast that they would receive £20 billion of revenues in the coming three years from oil if oil taxes were devolved. I think it is going to be probably around one third of that, well, that was the most recent forecast published and, of course, the oil price has fallen further since.

“So, they don’t have a particularly great track record and, of course, if Scotland had become independent, if the people of Scotland had voted for independence, the promises that the SNP had made to the people of Scotland, they would not have been able to deliver on because they have got their wildly optimistic, and that’s a polite way of putting it, forecasts about oil tax.

“So, one of the great benefits of the United Kingdom is that we can help each other when things like the oil prices change dramatically.”

Shadow chancellor Ed Balls and Scottish Labour leader Jim Murphy are taking part in talks in Aberdeen with representatives of the oil and gas industry as part of a day of action to address Scotland’s oil “crisis”.

Labour has accused the governments in London and Edinburgh of “inaction” over the issue and said the pair will discuss what both administrations need to do to help the sector.

Energy Secretary Ed Davey briefed the Cabinet on oil prices at this morning’s weekly meeting at 10 Downing Street.

Prime Minister David Cameron’s official spokesman told a regular Westminster media briefing that Mr Davey stressed the importance of oil companies passing on the fall in oil prices to customers, as well as the impact on the industry in the North Sea.

“The point was made about the fall in prices being passed on to customers and the importance of considering the impact on the North Sea oil sector,” said the PM’s spokesman.

“In terms of policy, there was noting of the fact that this Government has taken the right approach in terms of ensuring that families don’t miss out on falls in prices by repeatedly rejecting the idea of a (price) freeze.”

The spokesman indicated that the Treasury will engage with the oil sector in the usual way ahead of Mr Osborne’s Budget in March, and said that there had already been discussions on issues including investment allowances and decommissioning relief.

Asked whether Mr Cameron would be speaking to oil companies in Scotland, the spokesman said: “The Prime Minister regularly travels to all parts of the UK. He has met the energy sector in the past when he has been in Scotland and I’m sure that will continue.”

Recommended for you