‘Big-metal’ contracts are being issued; development of the massive Johan Sverdrup field has started; Norway can look forward to the future with renewed confidence.

It was in September 2010 when Lundin disclosed that it had made an oil discovery with exploratory well 16/2-6 on the Avaldsnes prospect in the Norwegian part of the North Sea.

Drilled to a vertical depth of 2,132m (6,995ft), the well encountered a 17m column of oil in the Draupne and Hugin formation in the Upper to Middle Jurassic.

A formation test was carried out showing very good flow properties. Even with just one well, Lundin was confident that the discovery harboured recoverable resources of 100-400million barrels oil equivalent (MMboe). Additional appraisal wells were immediately planned.

In July 2011, Norway’s Petroleum Safety Authority granted Statoil permission to drill two exploratory wells on the Aldous Major and Aldous North prospects, not far from where Lundin made its Avaldsnes find.

Statoil and partners in the licence, which included Lundin, believed that Aldous would turn out to be linked to the latter’s Avaldsnes find. Wells, 16/2-8 and 16/2-9S, would be two-of-four planned for the area in 2011.

In July, Statoil started on well 16/2-8 in the Aldous Major South structure. The main target was sandstone of Upper and Middle Jurassic age with secondary targets in Cretaceous Shetland Group chalk and the Triassic Skagerrak formation.

The following month, Statoil struck pay-dirt. The company said data acquired confirmed a reservoir of excellent quality with initial volumes in the 200-400million boe range, with upside expected.

Statoil said too that well 16/2-8 indicated the same oil-water contact as in the Avaldsnes discovery well, pointing to communication between the two finds, something that appraisal work was to confirm.

Later in August, Statoil confirmed communication between Aldous and Avaldsnes and that combined, they added up to an oil structure of 500million to 1.2billion boe recoverable.

The state operator said too that if the upper part of the interval was to contain hydrocarbons, then the discovery would rank as one of the 10 largest oil finds ever made on the Norwegian Continental Shelf.

Statoil then went on to spud the Aldous Major North well 16/2-9 to define additional potential and, together with Lundin working on its side of the fence, a giant emerged and which came to be named John Sverdrup. They had a massive asset on their collective hands and, a year ago, the partners agreed to the first phase of the joint asset’s development.

With gross recoverable contingent resources by then estimated at 1.8-2.9billion boe, Johan Sverdrup was re-ranked as one of the five largest fields to be discovered in Norwegian waters.

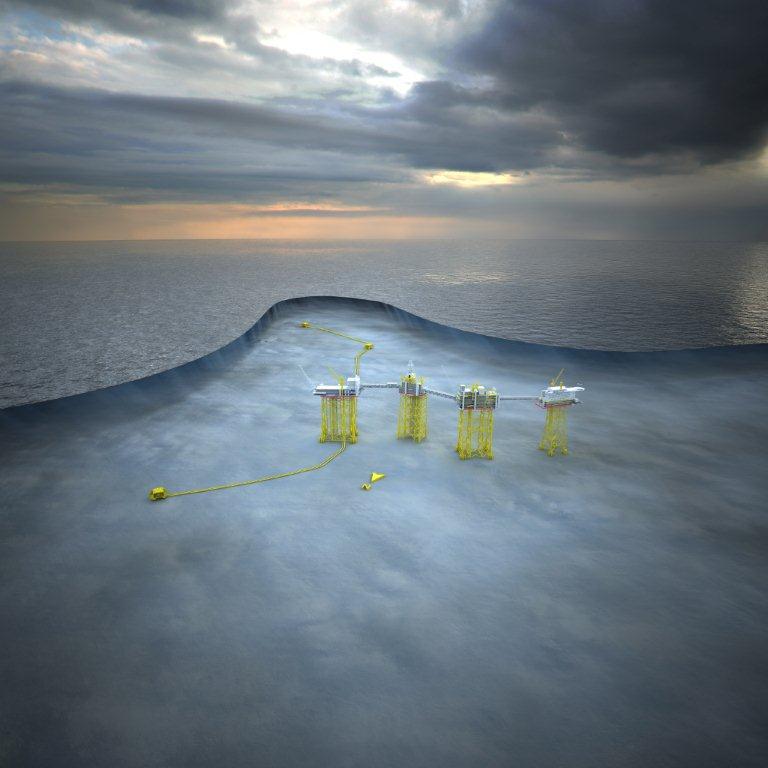

Phase 1 would be around four steel-jacket bridge-linked platforms, with associated subsea installations.

First oil was timed for 2019 with a gross production capacity of 315,000 to 380,000boe per day based on 40-50 production and injection wells. Gross capital Phase 1 investment would be $16.5-19.5billion, with the development plan to be submitted to Norwegian Petroleum Directorate early this year; indeed this month.

At the end of last year, Statoil was recommended as operator by its partners in the project. They include Lundin, Maersk Oil, Det norske and state-owned Petoro. Once operational, the partnership plans to achieve a recovery rate of at least 70% from the development which now comprises the Johan Sverdrup, Aldous, Avaldsnes and Cliffhanger North discoveries

It was late 2013 when Aker Solutions was issued a FEED contract and, last month, the company was conditionally awarded a $591million engineering and procurement management contract (EPMA) covering the riser and processing platform topsides together with hook-up work and gangways for the entire field.

Also last month, Statoil awarded a construction contract worth more than $260million to Kvaerner Verdal for the riser platform jacket.

The contract follows on from the letter of intent signed last year for the delivery of two Johan Sverdrup jackets and is conditional upon the project receiving regulatory approval and a final investment decision this month.

Phase 1 would be around four steel-jacket bridge-linked platforms, with associated subsea installations

Recommended for you