Scottish Gas owner Centrica will unveil plans to slash spending and potential job cuts as it grapples with low oil prices and the effects of warm weather.

The new boss of the firm, Iain Conn, is this week expected to reveal a 29% plunge in operating profit to £1.9 billion, according to City estimates.

Mr Conn, a former BP executive, will present Centrica’s annual results on Thursday just six weeks after he took over the role from former chief executive Sam Laidlaw who had been at the helm for eight years.

The group is expected to move to cut costs as weak oil prices hit its upstream business in the North Sea, as well as mitigate a fall in earnings from residential energy supply impacted by warmer weather.

The firm became a major North Sea player with its £1.3billion acquisition of Venture Production in 2009.

Analysts predict upstream profits will have fallen by a third last year.

Meanwhile, Credit Suisse believes the fall in the price of a barrel of oil will see the firm forced to write down the value of its North Sea assets by £1.5billion and cut its £900million annual spending plans by a third.

Centrica is forecast to report profits down 27% to £425million from its retail division as customers used less energy than a year ago.

In November the company said it had also been losing customers, with the total exodus for the year to date at 250,000. Industry figures had shown record switching to smaller suppliers.

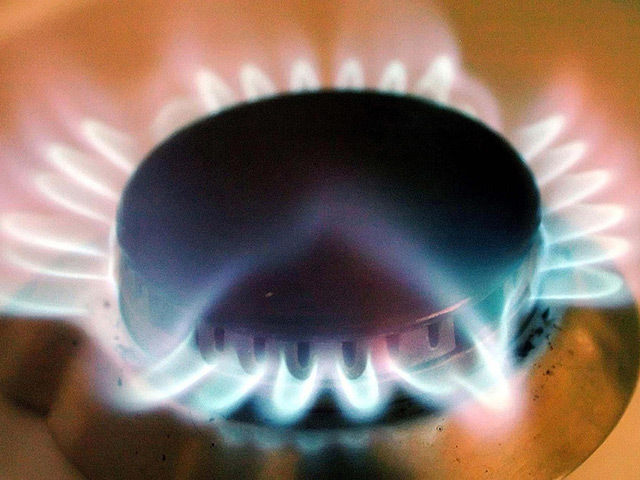

Since then British Gas, along with other Big Six suppliers that dominate the domestic energy market, has come under pressure to cut household tariffs to pass on the cost of falling wholesale gas prices.

It said last month that it would reduce them by 5% from February 27, cutting the typical household’s annual energy bill by £37. All the Big Six suppliers have now cut prices but there has been criticism that the reductions are too small.

Recommended for you