Ghana can’t drill new oil wells in a disputed sea area with Ivory Coast, according to a special tribunal. The order may impact producers, including Tullow Oil Plc.

Ghana and Ivory Coast “shall pursue cooperation and refrain from unilateral action that may lead to aggravating the dispute,” the Hamburg-based International Tribunal for the Law of the Sea said in a statement on its website Saturday. The order is provisional pending a final decision.

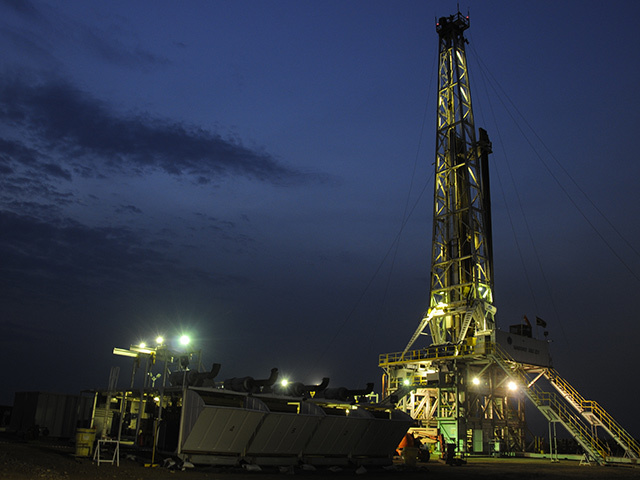

Ivory Coast challenged sea boundaries with neighboring Ghana and asked the arbitration panel to order Ghana to halt drilling in an area where Tullow operates its Tweneboa-Enyenra-Ntomme project. TEN is set to produce its first oil in mid-2016.

“The TEN project can move ahead and we will now await instructions from the Government of Ghana with regard to implementing those provisional measures that have been ordered” by the tribunal, Tullow spokesman George Cazenove said in an e-mailed response to questions.

A full verdict on the dispute from the panel isn’t expected until late 2017, according to London-based Tullow. The tribunal asked both countries to submit a report by May 25 that describes what measures have been taken after Saturday’s order.

A ruling in Ivory Coast’s favor would probably result in TEN becoming part of a joint development zone between the two countries, which may affect the fiscal regime the asset operates under, James Hosie, an analyst at Barclays Plc, said in a note.

Ivory Coast will seek to have the disputed area incorporated within its border, Bruno Kone, government spokesman, said by telephone after the decision. Ivory Coast President Alassane Ouattara will continue talks with Ghanaian President John Dramani Mahama, he said.

Ghanaian Energy Minister Emmanuel Armah-Kofi Buah didn’t immediately return calls and text messages to his mobile phone after hours Saturday.

Crude is Ghana’s biggest export by value after gold, and the nation produces about 100,000 barrels daily from its Jubilee oil field that’s operated by Tullow. The country was the largest contributor to the producer’s sales revenue in 2014 at $1.3 billion, or 58 percent.

Barclays values the company’s stake in the TEN project at 157 pence a share, and its tangible net asset value of 527 pence a share assumes the boundary is upheld with no suspension of activity.

The stock was little changed at 418 pence by the close in London on Friday.