Saudi Arabian stocks traded near a six-month high as investors awaited an announcement by the country’s regulator on rules opening up the market to foreigners for the first time.

The Tadawul All Share Index rose and fell as much as 0.3 percent before trading 0.2 percent lower at 12:18 p.m. in Riyadh. Al Rajhi Bank, the lender with the biggest weighting on index, added 0.2 percent.

The Riyadh-based Capital Market Authority will publish the final regulations today to allow foreigners direct access to its stock market starting June 15. The rules will be enacted June 1.

“There is nervous anticipation in the market,” Mohammed Al-Suwayed, a Riyadh-based financial analyst and partner at SPT Investors LLC, a market-analytics company, said by phone. “Investors are not very sure what sort of changes there will be, hence the fluctuation.”

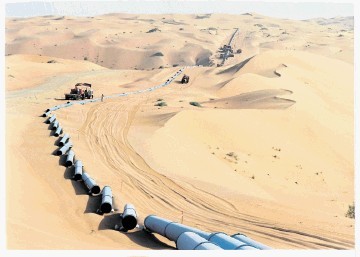

OPEC’s biggest oil exporter is removing barriers to one of the world’s most-restricted major stock markets as it pursues a $130 billion spending plan to boost non-energy industries. Investors from outside the six-nation Gulf Cooperation Council currently access shares listed on the country’s $572 billion market through equity swaps and exchange-traded funds.

The CMA may allow institutional investors with a minimum of 18.75 billion riyals ($5 billion) under management to invest directly in the stock market, according to the draft rules published in August.

It may lower the minimum to 11.25 billion riyals, it said.

“Investors aren’t expecting major changes from what we have seen in the draft regulations, but we have a new guy at helm, so you never know,” Al-Suwayed said. Mohammed Al-Jadaan was named the CMA head Jan. 30, a week after King Salman ascended to the throne.

The regulator may issue a list of companies open to foreign investors and limitations on ownership for each stock, the London-based newspaper Asharq al-Awsat newspaper reported on Sunday, citing reports from the Saudi regulator.

Saudi Arabia, a nation for which oil accounts for about 90 percent of foreign revenue, is burning through cash reserves at a record pace. The 48 percent drop in oil prices last year has prompted the government to use reserves and borrow from domestic banks to maintain spending on wages and investments.

The kingdom spent $36 billion of the central bank’s net foreign assets — about 5 percent of the total — in February and March, the biggest two-month drop on record, data released last month show.

The Tadawul All Share Index is the best performer among seven major gauges in the six-nation Gulf Cooperation Council this year, rising 17 percent to near the highest level since November.

Saudi Arabia may be added to MSCI Inc.’s emerging arkets index by 2017 at the earliest, accounting for about 4 percent of the index Sebastien Lieblich, executive director at MSCI Index Research, said in July.

Among stocks listed on the Tadawul are Saudi Basic Industries Corp., the world’s biggest petrochemicals producer by sales, Kingdom Holding Co., the investment vehicle of billionaire Prince Alwaleed bin Talal Al Saud, and Al Rajhi Bank, the largest Islamic lender globally.