Hedge funds reduced both bullish and bearish bets on oil for a fourth week as rising OPEC output was met with forecasts for a contraction in U.S. supply.

Money managers trimmed their short wagers in West Texas Intermediate oil by 4.3 percent and long bets by 0.2 percent, leading to a 0.8 percent gain in the net-long position, U.S. Commodity Futures Trading Commission data for the seven days ended June 16 show.

Trading in futures is falling as WTI swings in a $5 range, the narrowest in 19 months. The Organization of Petroleum Exporting Countries pumped the most oil last month since October 2012, while the U.S. government says output will start falling from this month. Investors are watching a June 30 deadline for Iran and six other nations to reach a nuclear deal that could lift oil sanctions and further swell a global supply glut.

“It’s tough to get conviction one way or the other,” John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy, said by phone June 19. “The narrow range can lead to diminished activity until the market can get a break-out signal.”

WTI futures fell 17 cents to $59.97 a barrel on the New York Mercantile Exchange in the period covered by the CFTC report and settled at $59.61 on June 19. The grade lost 6 cents to $59.55 at 11:50 a.m. Singapore time Monday.

Saudi Arabia, OPEC’s biggest member, is ready to produce more oil if demand rises, Oil Minister Ali-Al Naimi said June 18. It has 1.5 million to 2 million barrels a day of spare capacity, he said.

Libya may double output to 800,000 barrels a day by next month, according to Mohamed Elharari, a Tripoli-based spokesman for the state-run National Oil Corp.

Iran Supply

Iranian Oil Minister Bijan Namdar Zanganeh presented a letter earlier this month urging OPEC to make way for his country to pump 4 million barrels a day, back to the level of about 2008 before Western sanctions intensified. Iran produced 2.8 million barrels a day in May, according to data compiled by Bloomberg.

“The market is worried about OPEC overproduction,” Michael Hiley, head of over-the-counter energy trading at LPS Partners Inc. in New York, said by phone June 18. “There’s just too much oil out there.”

OPEC kept its production target at 30 million barrels a day earlier this month at a meeting in Vienna, maintaining the strategy of defending its share of the global oil market rather than prices. The group pumped 31.6 million barrels a day in May.

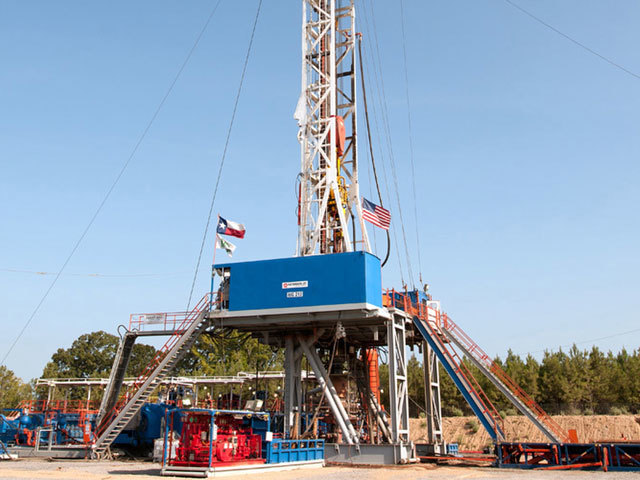

U.S. Output

In the U.S., oil output will fall to 9.19 million barrels a day in February from 9.59 million last month, the Energy Information Administration said. Production will average 9.43 million barrels this year, the most since 1972. The number of rigs searching for oil dropped by 4 to 631 in the week ended June 19, the lowest level since August 2010, Baker Hughes Inc. data show.

Daily production from shale formations such as North Dakota’s Bakken and Texas’s Eagle Ford will shrink 1.3 percent to 5.58 million this month, based on EIA estimates. It’ll drop further in July to 5.49 million, the lowest level since January.

Long positions in WTI fell by 688 futures and options combined last week while shorts dropped 2,510, according to the CFTC. The net-long position gained 1,822.

In other markets, bullish bets on Nymex gasoline increased 38 percent to 27,143. Futures rose 2.3 percent to $2.1245 a gallon on the exchange in the reporting period.

Bearish wagers on U.S. ultra low sulfur diesel fell 40 percent to 4,073 contracts. The fuel slipped 1.7 percent to $1.8849 a gallon.

Natural Gas

The net-short position on U.S. natural gas decreased 23 percent to 75,742. The measure includes an index of four contracts adjusted to futures equivalents. Nymex gas rose 1.7 percent to $2.894 per million British thermal units.

U.S. oil inventories fell for seventh time, to 467.9 million barrels in the week ended June 12. That’s still 80 million more than a year earlier. Supplies at Cushing, Oklahoma, the delivery point for WTI futures, increased for the first time in eight weeks.

“There are too many mixed signals,” Tariq Zahir, a New York-based commodity fund manager at Tyche Capital Advisors, said by phone on June 19. “Traders are sitting on the sidelines.”

Recommended for you