U.S. oil refiner PBF Energy is shipping a cargo of crude from Western Canada to supply its plant on the other side of the continent, a rare move traders say is a sign steep discounts for oil sands are upending age-old trade routes.

The deal set the market abuzz on Wednesday with traders speculating about the status of the shipment of up to 500,000 barrels of crude.

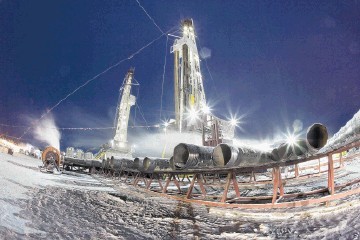

Two traders said PBF picked up a cargo coming from the Kearl oil sands projects operated by Imperial Oil in northern Alberta at a hefty discount.

Sending the cargo by tanker on a 7,000-mile trek through the Panama Canal to the company’s plant in Delaware is remarkable for many reasons.

East Coast refiners usually receive crude by rail from domestic shale plays or by oil tanker from locations including West Africa, eastern Canada and Mexico.

Western Canadian crude comes into the United States by train or pipeline, rarely by boat, and even more unusually to the East Coast.

“It’s been done before, but it’s a weird way to go around,” said a Canadian trader.

While it’s not clear if it may mark the start of a series of buys, traders said the purchase illustrates how the deepening discounts for Canadian crude compared to U.S. and global material is drawing unusual buyers and overhauling buying strategies by refiners as the oil price rout shows no sign of ending.

PBF declined to comment. Spokesman Michael Karlovich said the company treats all commercial and logistical related issues as confidential.

The shipment headed west from the Kearl oil sands via pipeline to the Kinder Morgan terminal in Vancouver and was loaded on a Liberian-flagged panamax named DS Promoter in mid-July, according to two trading sources and Reuters shipping data via Eikon.

On Wednesday, it had just passed through the Panama Canal on its way to Delaware City. The route can take about 20 days.

Traders say PBF was seen looking for line space on the Trans Mountain pipeline recently, a 300,000 barrel-per day line which runs from Edmonton, Alberta to Vancouver.

PBF’s 182,000 barrel-per-day refinery consumes a variety of Canadian crudes, federal data shows, all of which is either carried by rail directly to the plant or to Albany, New York, where it is loaded on a barge before heading south.

PBF “seems to be evolving its crude slate and its logistical capabilities,” said a U.S. trader.

Western Canada Select heavy blend crude for September delivery last traded at $17.85 per barrel below the West Texas Intermediate benchmark, according to Shorcan Energy brokers, down from Tuesday’s settlement of $17.10 per barrel below WTI.

That’s the lowest differential this year. The outright price of WCS crude, the de facto oil sands benchmark grade, has tumbled below $30 a barrel in recent weeks as global oil prices slumped on rising supply from the oil sands and limited space on pipelines transporting Alberta crude to the U.S. Gulf Coast.