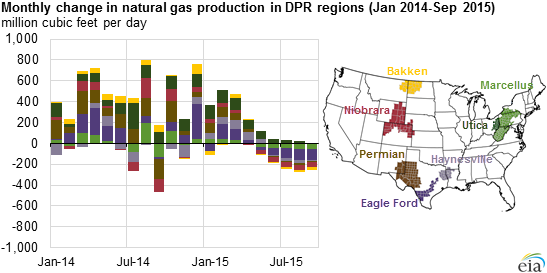

Natural gas production across all major shale regions in Energy Information Administration Drilling Productivity Report (DPR) is projected to decrease for the first time in September.

Production from these seven shale regions reached a high in May at 45.6 billion cubic feet per day (Bcf/d) and is expected to decline to 44.9 Bcf/d in September.

In each region, production from new wells is not large enough to offset production declines from existing, legacy wells said the EIA.

The EIA’s Grant Nulle said: “Several external factors could affect the estimates, such as bad weather, shut-ins based on environmental or economic issues, variations in the quality and frequency of state production data, and infrastructure constraints.”

The DPR provides a month-ahead forecast of natural gas and crude oil production for the seven most significant shale formations in the United States.

In order to estimate total natural gas production within a DPR region in a given month, production from both new wells and legacy wells must be taken into account.

As rig counts fall, increases in rig productivity are necessary not only to compensate for the reduced rig total, but also for rising levels of legacy-well declines.

Given the substantial drop in rig counts since the fourth quarter of 2014 in each of the DPR regions and growing declines in production from legacy wells, productivity increases are less able to completely offset lower rig counts and legacy-well declines.

The Utica region in eastern Ohio is the only DPR region expected to show production increases in June, July, and August.

The DPR provides a very near-term forecast in specific plays based on the most current information.

Longer term outlooks that include play-level detail, such as the Annual Energy Outlook, reflect resource and technology assumptions and projected prices and often move in different directions than the DPR, which reflects short-term factors.

Recommended for you