Iraq’s semi-autonomous Kurdistan Regional Government plans to start making its first regular payments to oil producers including DNO ASA, Genel Energy Plc. and Gulf Keystone Petroleum Ltd. within seven days. The companies’ shares rallied.

The Ministry of Natural Resources authorized the allocation of $75 million of revenue from the KRG’s direct sale of crude oil as payments, the ministry said in an e-mailed statement on Monday. Operators of the Taq Taq oil field including Genel Energy will receive $30 million, Tawke field operator DNO will get $30 million and Gulf Keystone, the operator at Sheikhan, will receive $15 million over the next seven days, it said.

“Regular payments will be needed to allow the exporting companies to cover their ongoing expenses and plan for further investment in the oil fields, which will in turn boost production and thus help the people of the Kurdistan region,” according to the ministry statement. Additional payments will be made as Kurdish shipments rise in 2016, it said.

The payments would be the first schedule compensation to companies that have been caught for years in a dispute over revenue sharing between authorities in the northern Kurdish enclave and Iraq’s federal government. Genel’s shares gained 6.1% percent, while DNO and Gulf Keystone Petroleum also rallied.

Last Payments

Gulf Keystone received $15 million in a previous payment from the KRG in December, Tony Peart, the company’s legal and commercial director, said in an Aug. 27 presentation. Genel and DNO received a combined $60 million from the authorities, according to statements in December.

Even after Iraq’s central government agreed with the Kurds in December to allow increased oil shipments, payments continued to elude producers after the collapse in oil prices squeezed KRG budgets. Crude exports are the main source of revenue for the KRG to pay for government salaries and services and finance the costly war against Islamic State militants, according to the statement.

“The steep fall in the price of oil means the KRG continues to struggle to cover its minimum financial needs,” the ministry said. “But it is also recognized that it is unrealistic to expect the international oil companies to be able to sustain oil export at current levels without receiving some of their financial dues on a predictable basis.”

Brent crude, a global pricing benchmark, fell more than 50 percent last year and was trading at $49.05 a barrel at 10:03 a.m. in London.

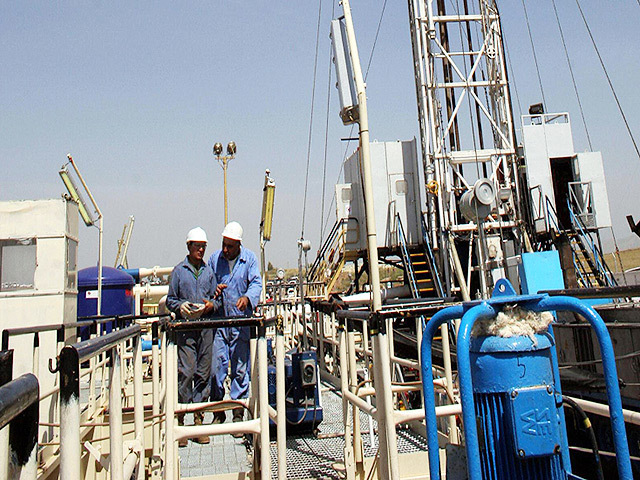

Iraq’s minority Kurds, who historically have resisted control by the central government in Baghdad, are independently developing oil reserves they say may total 45 billion barrels. That’s equivalent to almost a third of Iraq’s deposits, according to BP Plc data. The KRG exported 472,832 barrels a day in August, down from 516,745 barrels a day in July, because of sabotage and theft inside Turkey, according to a Sept. 3 ministry statement.