Union Jack Oil confirmed it was perfectly poised to capitalise on current market ‘dislocaton’

According to the company’s half year financial report, Union Jack has a cash position in excess of £2.5million, no debt and is fully funded for the current planned drilling programme.

Chairman David Bramhill said: “Union Jack is well placed to take advantage of the dislocation that currently exists within the oil and gas market. The company’s strategy is to continue focusing on its low-cost UK onshore portfolio and similar opportunities, with a view to generating additional value for its shareholders.

“To that end the company has already utilised its robust balance sheet position to increase its interests in drill-ready projects at Biscathorpe and North Kelsey and to acquire an interest in the producing Keddington oilfield at an attractive entry point post period end.”

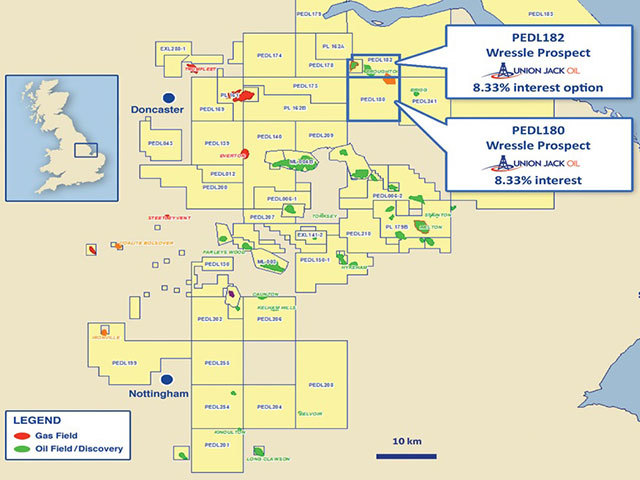

The firm’s flow testing of its Wressle-1 discovery well returned in excess of 700 barrels of oil equivalent per day gross, according to the report.

A the firm will now submit a planning application for early oil production for the well.

Union Jack recently completed the acquisition of interests in the Keddington oil field.

Recommended for you