The takeover of Simmons & Co. by Piper Jaffray Cos. marks the end of an energy industry dealmaker founded by one of the leading champions of the “peak oil” theory, Matthew R. Simmons.

Simmons was best known for his claim that the Earth was running out of crude, promoting the idea that world oil reserves were peaking in a 2005 book called “Twilight in the Desert.” He died at 67 in August 2010, on the eve of the U.S. shale boom that sent the nation’s crude output to the highest level in four decades.

“The peak oil people were looking at a finite resource,” Sarah Emerson, managing director of ESAI Energy Inc., a consulting company in Wakefield, Massachusetts, said by phone. “Their opponents said this is an industry that’s endlessly innovative. The industry has won big.”

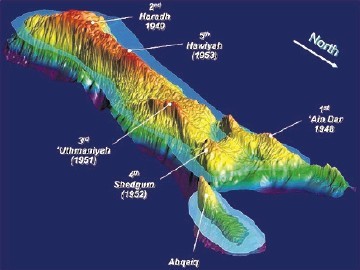

On a tour of Saudi Arabia’s oil industry in 2003, Simmons was inspired to estimate the world’s largest oil reserves, and from research that included poring through neglected engineering data, determined that the country was close to or nearing peak output, Peter Maass wrote in his book, “Crude World: The Violent Twilight of Oil.” Saudi Arabia pumped 10.57 million barrels a day in July, the most in monthly data going back to 1989 compiled by Bloomberg.

Simmons was a frequent critic of BP Plc’s efforts to stanch its oil spill in the Gulf of Mexico, suggesting at one point that the best option would be to detonate a small nuclear bomb undersea to kill the well.

Houston-based Simmons, which offers research, institutional sales and investment banking in the energy industry, was founded in 1974. Piper Jaffray will pay$139 million, with $91 million in cash and the rest in restricted stock to take over the company, according to a statement Tuesday.