At almost any other time, an escalating diplomatic conflict between OPEC members Iran and Saudi Arabia would mean a spike in oil prices.

That the rally this time couldn’t be sustained shows just how abnormal things are in the oil market. Brent crude erased an initial gain of more than 4 percent Monday as a global supply glut and the slowest Chinese growth in a generation trumped mounting strife between the nations on either side of the world’s busiest waterway for oil tankers.

“When oil supplies were tight, we’ve seen bigger reactions to geopolitical tensions,” Tushar Tarun Bansal, a senior oil analyst in Singapore at industry consultant FGE, said by phone. “Now the price rise has actually been quite muted because the world is in a surplus situation.”

There was little more than a blip in crude futures when Saudi Arabia severed diplomatic ties with Iran, as investors focused instead on record stockpiles and rising supply. As Kuwait and the United Arab Emirates lined up to support Riyadh, the internal divisions that prevented the Organization of Petroleum Exporting Countries from making production cuts even as prices plunged to an 11-year low appeared more entrenched than ever.

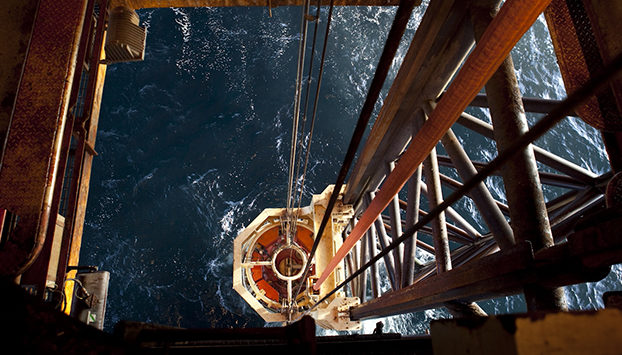

Awash in Oil

Saudi Arabia gave Iran’s ambassador 48 hours to leave after protesters set its embassy in Tehran on fire following the execution of Saudi cleric Nimr al-Nimr, a critic of the kingdom’s treatment of its Shiite minority. It was the worst clash between the nations since the 1980s, adding to proxy wars they were already fighting from Syria to Yemen in a quest to gain influence in the Middle East.

The impact of the tensions is limited because the oil market remains oversupplied, Macquarie Group Ltd. analysts including Vikas Dwivedi said in a note. The events “may severely limit the possibility of peace in surrounding countries, but do not directly threaten crude oil production,” the bank said.

The world is awash in oil after OPEC members led by Saudi Arabia committed to a strategy of increasing market share by pressuring high-cost producers, rather than cutting output to support prices. This policy has resulted in record oil inventory levels that will probably keep growing for most of the year, the International Energy Agency said last month. This provides a cushion against any unexpected turmoil.

Eastern Province

Brent, the global benchmark, rose as much as 4.6 percent on Monday on the London-based ICE Futures Europe exchange before erasing the gain to settle down 0.2 percent. Prices were up 0.2 percent at $37.28 a barrel at 2:31 p.m. in Hong Kong on Tuesday.

Should violence break out in the Eastern province of Saudi Arabia, home to most of its Shiite community and its richest oil fields, the impact on prices could be more significant, according to Alexandre Andlauer, an oil analyst at AlphaValue SAS in Paris.

“The Saudis will move quickly to quash any violence, but the question will be whether they can keep any protests from flaring out of control,” Andlauer said.

OPEC Divide

The dispute strengthens the biggest bearish factor in the oil market in the past year — OPEC’s decision to keep pumping amid falling prices.

Saudi Arabia and Iran are the largest and fifth-biggest producers in OPEC, respectively. Their worsening relations make it even less likely the group could overcome internal differences and agree to an oil-output cut to boost prices, Macquarie said.

Last month, OPEC effectively abandoned any limits on output and boosted production, according to a Bloomberg survey. The group would need to reach a consensus before making any change of policy that could reduce the glut.

While Iran is set to boost to oil production as sanctions on its nuclear program are lifted this year, it has called on other OPEC members to cut output. This is opposed by Saudi Arabia and its Gulf allies.

The U.A.E. reduced its representation to Iran, while Kuwait said it backed “all measures adopted by Saudi Arabia to maintain its security and stability,” according to an unnamed Foreign Ministry official cited by the KUNA news agency.

“When you see an escalation of this sort — which is sectarian in nature and involves the broader OPEC group — it just makes things even more difficult,” Virendra Chauhan, a Singapore-based oil analyst at consultant Energy Aspects Ltd., said by phone. The organization is now “less likely to come to some kind of broader output cut,” he said.

Recommended for you