Cluff Natural Resources (CLNR) is to pursue unconventional opportunities south of the border following the Scottish Government’s moratorium on Underground Coal Gasification.

The firm, which has stopped all expenditure related to the Kincardine Project in Scotland’s central belt, said it would focus its attention outside of Scotland, in particular north east England, where the political situation is more favourable to unconventionals.

CLNR has nine UCG licences in the UK, six of these are based in England and Wales and not subject to the moratorium.

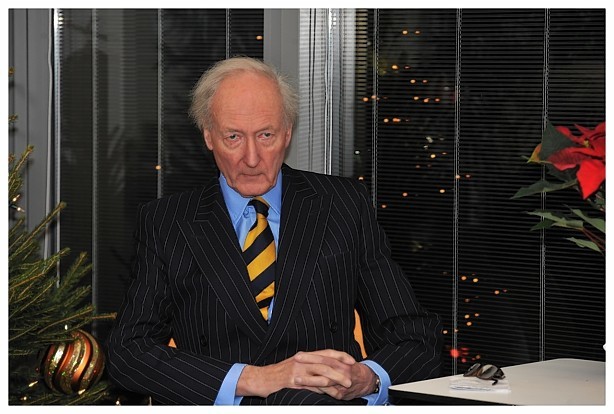

Oil and gas entrepreneur Algy Cluff, CLNR chairman and chief executive, said the company had endured a “challenging year”, along with whole natural resources sector, but said the firm’s Southern North Sea prospects promised significant potential as the firm switched focus from underground coal gasification into conventional opportunities.

This was precipitated by the introduction of the moratorium on UCG in Scotland in October 2015 despite previous assurances the company had received from the Scottish Government. The moratorium will remain in place, pending a government study and public consultation, which is expected to conclude in spring 2017.

Announcing a pre-close update for 2015, Cluff said: “”With no debt or major work commitments, CLNR is in a comparatively strong position to take advantage of opportunities which may arise given the challenging oil price environment. Our objective now is to complete the process of attracting the partners required to fully appraise the production potential of these exciting assets.”

“2015 was a challenging year for the natural resources sector as a whole, however we were extremely pleased to be able to announce the completion of an independent assessment of the prospectivity of our portfolio of Southern North Sea licences which confirmed the excellent potential associated with previously acknowledged discoveries as well the significant upside that exists.”

Cluff said the firm was working on a detailed appraisal programme for the Lytham discovery to gather missing data required to de-risk potential future development.

In 2015, the company entered into a memorandum of understanding with Halliburton to collaborate and accelerate the development of the company’s assets and culminated in the publication of a competent persons report and estimate of prospective resources which was announced in December 2015 and which demonstrated significant gas potential.

CLNR said it was unlikely to would receive £331,125 still owed by the buyer of nearly 7.8 million shares shares in the company’s placing earlier in the year and is considering its next course of action.

Despite this, early action to curtail major costs associated with the Company’s UCG project at the Kincardine Project, coupled with an “on-going discipline and focus on overall cost control”, meant that the company was in fact in a stronger cash position (£1.1million) at the 2015 year-end than anticipated at the time of the placing.

CLNR is currently looking to secure one or more industry partners to fund forward work programmes, including the drilling of one or more wells, will become a key focus in 2016.