The managing director of Wood Group PSN’s operations in the UK and Africa said Africa offered “fantastic opportunities” for the North Sea oil and gas industry.

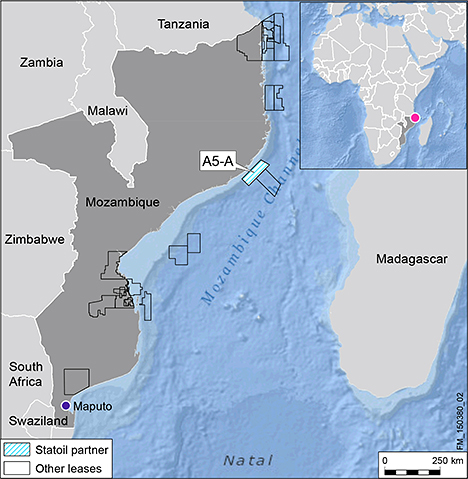

James Crawford said opportunities in emerging basins such as Mozambique, Kenya and Tanzania were still largely undeveloped.

The Secretary of State for Scotland David Mundell last month embarked on a whistle-stop tour of Mozambique as Aberdeen City Council looks to strengthen links with the region.

Crawford said: “We have got the new basins in the east like Kenya and Tanzania which are still largely undeveloped. There are fantastic opportunities.

“Mozambique has the fifth largest gas supplies in the world. There are particular opportunities there for business and it’s an exciting one for us.

“In Tanzania and Kenya we have been quite focused on that region for the past five years.”

Industry experts have previously pointed to the promising opportunities for growth available to supply chain companies.

When developed, Mozambique gas reserves have the potential to transform the country’s fortunes.

Its government is working to ensure that local enterprises and local population will play a significant role in the development of the industry.

Operators in East Africa, including Anadarko, ENI, BG, Shell and Petrobras, are looking to spend an estimated £100billion on developing the fields, believed to contain 170trillion cubic feet of gas.

Crawford also pointed to one area where the company has had much success – Cameroon.

Wood Group has developed its staff and local content in the country which has meant their operations there have zero expatriate employees.

One of the employees who started working for the company there as an admin assistant has since gone on to become general manager at the company’s operations in Cameroon.

He said $85million has been spent on both training and development in Africa in the last six years alone.

Effort has also been made in shaping the curriculum of a number of universities and colleges to cater for the oil and gas industry.

Crawford said the company was taking “long-term view” on the current oil price, adding that to take a “short-term view” would be a “bad place” to be.

Recommended for you