While Mozambique is presently recovering from the destruction caused by Cyclone Idai, it has the potential to produce close to 10% of the current global market or 6x the LNG production of Angola.

Two mega LNG projects should be sanctioned this year in Mozambique, with investment of almost four times the country’s GDP. There is huge value creation potential for the people of Mozambique and a good return for the project participants, if the Government can ensure a sound economic environment. There is the potential for around US$100bn in cashflow to the Mozambique people, which would be transformational for Mozambique, when you consider that current GDP <$15bn and GDP per capita of <$500.

There are two key financing challenges which still need to be addressed: the ability of the partners to raise project financing debt and the funding of state oil company ENH’s obligations (both debt and equity).

Mozambique’s credit profile was downgraded after it defaulted on Eurobonds issued by the Mozambique Government. The partners are likely to see a higher cost of project financing debt facilities as a result. The higher borrowing costs will reduce the life of field revenues to the Government and pushes back when the Government can access the revenues. So, for the country and the economy to benefit, a stable economic climate is needed.

The initial three developments in Mozambique will develop ~40tcf (7bnboe) of reserves and see production reach 5bcf/d (~800kboe/d equivalent) or >30mtpa of LNG. The total development capex is >$50bn with ~2/3 of this likely to be project financed. Assuming an LNG price of $7.5/mcf, the yearly revenues from the projects will be $12bn by 2025 (close to Mozambique’s current GDP) or >$300bn over the life of the project.

ENH’s investment into the projects is around 50% of Mozambique’s GDP. It is important the Government has a clean financial bill of health, as it will need to rely on the debt market over the next decade, ahead of the future cash windfall in the 2030s. For example, the Government needs to provide a sovereign guarantee and is currently looking to refinance around $2bn of its exposure.

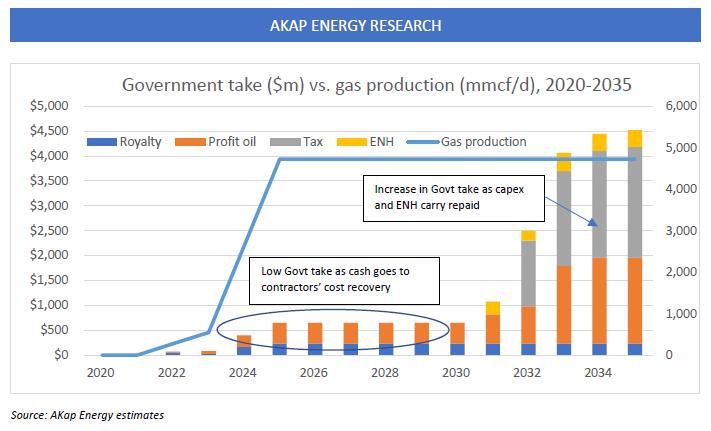

The gas finds are game-changing for Mozambique, if the political and economic environment will allow the projects to move forward. Although there will be an economic benefit during the construction phase, significant Government/ENH revenues will only be seen in the 2030s. Until 2030 ENH share of cashflow will go towards repaying its carried exploration spend to date (~$1.25bn on our estimates), and the development capex, currently carried by the partners. This could have implications on how Mozambique finances its domestic infrastructure projects and there may be a greater need for IMF support and access to international capital markets in the near term.

Between 2022-2030 the projects will generate around US$70bn in total pre-tax operating cashflow. The chart below shows that in this period <US$5bn will go to the Government, while the remaining cashflow will repay the capex and compensate the equity holders. In the 2030s, Government take increases to >US$4bn per annum.

Whilst these projects have the potential to be transformational for Mozambique, implementing policies supporting the country’s financing and development of these projects should be of paramount importance to the Government to ensure these projects are sanctioned.