The acquisition of Merlon Petroleum earlier this year has given Soco International a new focus, with new exploration planned in Egypt and neighbouring Israel. As such, the company is planning to change its name, to Pharos Energy.

Setting out its first half results, on September 11, the company reported production had reached 12,541 barrels of oil equivalent per day. This is up from 7,748 boepd reported for the same period of 2018. The increase was driven by the acquisition of Merlon, with Egypt accounting for 5,262 bpd of oil. The deal to acquire Merlon was completed in April, giving

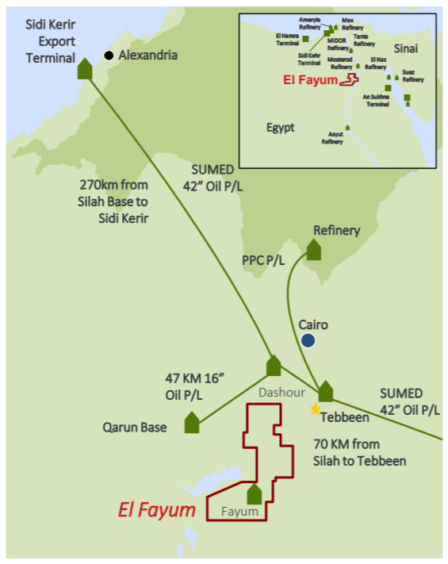

By the end of the year, output from the El Fayum concession, in Egypt, should reach 6,500 bpd, while production for the full year in Vietnam is expected to be 6,500-7,500 boepd.

Soco’s president and CEO, Ed Story, said Merlon had been successfully integrated into the company in the first half. “The acquisition significantly increases group reserves, resources and production, and importantly gives Soco the diversified base to grow production further. The Egyptian assets complement our Vietnamese portfolio and allow us to invest cash flow into activities focused on increasing reserves and production.” He went on to say drilling would increase in Egypt in the second half.

Revenues in the first half were $91.8 million, down from $93.2mn in the same period of 2018. Cash generated increased to $54.6mn, from $48.3mn, while net debt reached $33.7mn, from a net cash position of $128.8mn. Cash operating costs fell to below $10 per barrel, from $14. Capital expenditure for the year is expected to be $50mn. The total cost of the Merlon deal was $215.2mn, including $136mn paid to the Egyptian company’s shareholders and the repayment of $19.4mn of bank debt.

Soco works in Egypt’s El Fayum concession via Petrosilah, a 50:50 joint venture, with Egyptian General Petroleum Corp. (EGPC). There are two drilling rigs and two workover rigs on the licence. Oil from the licence was sold at a $5 discount to Brent during the first half, at $64 per barrel.

Since April, when the deal closed, Soco has drilled four production development wells and one injector. The company is focused on turning around the previous underinvestment on the block, through artificial lift and waterflood work.

For the rest of the year, the two drilling rigs will continue work on new production and injection wells, with the aim of increasing production. A third workover rig will be brought in during October. Soco also said it was planning on shooting new 3D seismic in the north of the concession – although this is contingent on approval from the military and clearance of unexploded ordinance.

Soco went on to highlight its work to reduce greenhouse gas emissions in Egypt, having recently exchanged diesel-fired generators for gas at North Silah Deep.

The company was awarded a 100% stake in North Beni Suef concession in February 2019, following a bid round. The first three-year phase will involve seismic and the drilling of two exploration wells. Soco has also secured stakes in eight blocks in Israel’s offshore bid round, where it will work with Cairn Energy and Ratio Oil Exploration. There are no drill commitments in the first three years.

The company will hold a capital markets day on October 29.

Recommended for you