London-listed Lekoil was the victim of a scam that has all the hallmarks of a classic advance fee fraud case, the company admitted at the close of January 13.

Shares were suspended yesterday morning. On January 10, it was trading at 9.5p per share, having increased from 4.65p as of December 31. The fictitious deal was announced on January 2. As of this morning, the share price had fallen to 3.23p.

Lekoil said it could no longer expect the funding would be forthcoming and that an investigation committee would be launched to examine how it had happened.

The deal was supposed to have been struck with the Qatar Investment Authority (QIA). It was brokered by a company seemingly based in Ghana, Seawave Invest, which lists a telephone number for some lawyers in Bahamas.

Lekoil said it had paid around $600,000, in advance fees to Seawave and in legal costs. The deal was supposed to see it raise $184 million, of which it would receive $174.3mn. The $9.7mn difference was to go to Seawave and with an upfront fee of 2.75% of the facility, or $5.06mn. It is unlikely that the cash paid out to Seawave can be recovered, Lekoil said.

Clearly, the deal was too good to be true. The QIA facility came with a proposed interest rate of 3.72%, which would have been substantially below those of Lekoil’s peers’ borrowings. In addition, the Seawave website is remarkably non-specific, with spelling errors and content copied from other financial companies.

Lekoil said the loan agreement had been entered into by “individuals who have constructed a complex facade in order to masquerade as representatives of the QIA”. It was only when legitimate QIA representatives got in touch with Lekoil on January 12 that the truth became apparent.

The QIA deal also had an agreement under which Lekoil’s CEO Lekan Akinyanmi was to put up his shares as a surety of the deal. The company agreed to give its CEO a bonus of $1.84mn, which would be set off against an earlier loan it had provided to him – effectively wiping this out. Akinyanmi was also granted another 30 million new shares that he would receive based on share price increases.

All of these agreements have been scrapped, with Lekoil saying that no payments had been made to the CEO or any other employee.

The Alternative Investment Market (AIM) listed company said it had carried out a due diligence investigation of the offering, based on “open source information” on Seawave. It had also asked for advice from its legal counsel. Lekoil declined to provide any further details on the due diligence process, including who had been responsible for its execution.

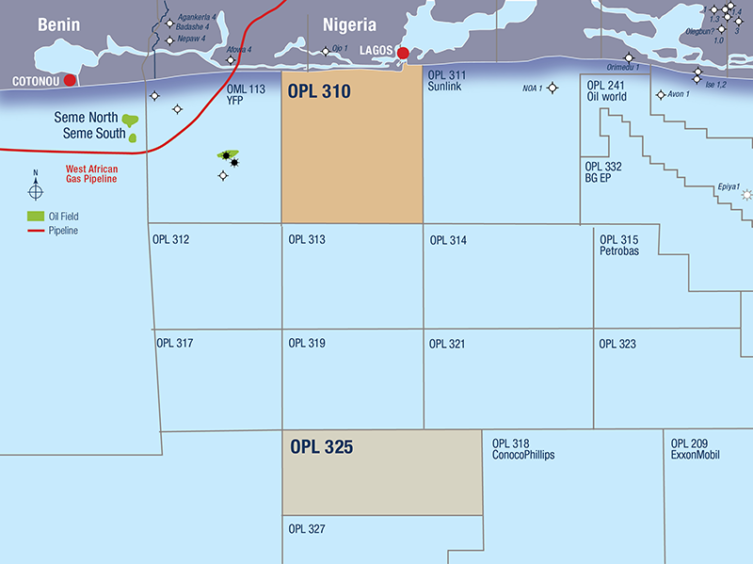

While Lekoil does generate cash, the company’s plans to drill two wells in OPL 310, starting in the second half of this year, seem unlikely. In the near term, it needs to pay its partner, Optimum Petroleum Development, around $10mn by February in addition to showing the ability to raise 42.86% of the costs of drilling one well, estimated at $28mn.

As of the end of 2019, the company had $2.7mn in the bank. Paying out $600,000 on the QIA masquerade leaves it far short of its needed goal. Proceeds of a lifting are due to be received this month, Lekoil said, but failure to meet its share of costs on OPL 310 are likely to result in the sale of its stake in the licence.

Lekoil appointed two new non-executive directors on January 3, Mark Simmonds and Tony Hawkins. Simmonds was a UK minister with responsibility for Africa, while Hawkins is the CEO of Columbus Energy Resources. These two non-execs will investigate the facility and see what cash might be able to be retrieved. They will be assisted by external forensic investigators and legal counsel, Lekoil said.

The QIA affair has a particular resonance given that the work was to be focused on OPL 310, where Lekoil had worked with Afren, until this company collapsed as a result of corporate malfeasance. Since that point, work has made no progress as Lekoil struggled with Nigerian bureaucracy and to line up financial backing.