SDX Energy is set for a year of growth, although there are some concerns about impairments that might see it relinquish one of its longest-term producing assets.

In an operating update, the company said production in 2019 had reached 4,020 barrels of equivalent per day, 12% above 2018, and was expected to reach 6,750-7,000 boepd in 2020.

The South Disouq gas project, in Egypt, started in November 2019 and reached plateau production of 50 million cubic feet (1.42 million cubic metres) per day in December. This is expected to contribute 4,300-4,460 boepd this year, representing around two thirds of production in 2020.

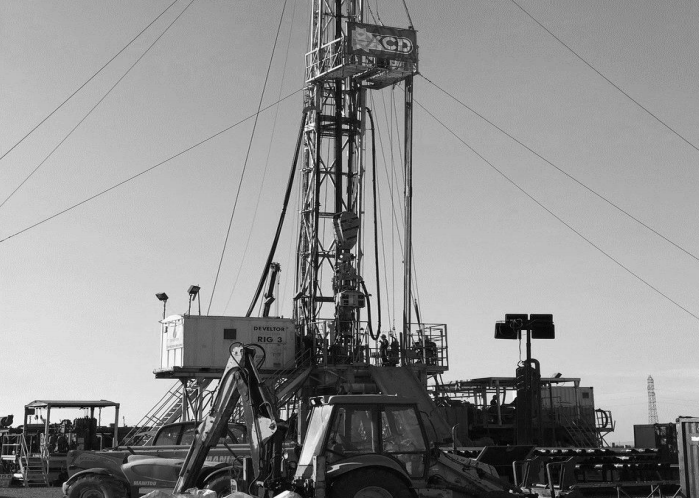

SDX is the operator of the licence, with a 55% stake, while IPR has the remaining 45%. The companies are planning to drill two wells this year – possibly three. The Salah and Sobhi wells have 35% chances of success and are close to the central processing facility (CPF), offering the option of low-cost tie ins should discoveries be made. Salah is expected to be spudded in mid-February, with completion due in April.

The existing facility could be increased to process 66 mmcf (1.87 mcm) per day, Reid said, but there are a number of calculations to be made about how best to proceed, whether to boost output now, to invest in more capacity and bring on at a higher level or extend the asset’s productive life. Plans would be dictated by the size of a find.

A third well, Young, has a larger potential size but the chance of success falls to 17% in a deeper horizon. Drilling of this well would require bringing in a partner. A farm-out would involve a carry on drilling but SDX is wary of finding the right balance between funding the well and sacrificing too much equity in the asset. “We don’t want to give away value. It’s large and exciting but high risk,” Reid said.

There is some uncertainty to this year’s output, though, as the company has warned its involvement in Egypt’s North West Gemsa asset might be coming to an end.

“If the monthly cash generation from selling our share of production is less than the cost to pay the operator to keep it running we would offer [our stake] back to the operator and if that’s not wanted back to the government. There are no decommissioning liabilities. Our base case is that unless there’s a major breakthrough restructuring costs, or there’s an uptick in oil prices, we expect to exit [NW Gemsa] in 2020,” SDX’s CEO Mark Reid told Energy Voice.

SDX projects that NW Gemsa will contribute 1,000-1,050 boepd this year, down from 1,800 boepd in 2019.

Problems at this project have contributed to SDX taking a non-cash impairment of $18mn. “There’s absolutely no impact on the business going forward” from this impairment, Reid said. In addition to the NW Gemsa asset, the impairment was driven by the South Ramadan licence, in the Gulf of Suez, and the southern part of the South Disouq licence, which SDX will not be able to explore before the licence expires.

This impairment “cleans up the accounting”, Reid said, “none of these assets are in our forecasts”.

Capital expenditure reached $40.7 million in 2019, higher by $4.5mn than expected, driven largely by being able to drill faster in Morocco than had been expected. Spending this year should fall to $25.5mn. As at the end of 2019, SDX had $11mn in cash.

The company does have a $10mn facility from the European Bank for Reconstruction and Development (EBRD). “The EBRD has been an excellent partner for us and hugely supportive” of SDX’s work in Morocco, Reid said. The structure of the facility is that the amounts available reduces as the tenor comes closer, with the $10mn initial amount having fallen to $7.5mn as of November and with another reduction due in July.

“We are in positive discussions on the effective extension of that facility. Morocco is a nice predictable business defined by fixed-price long-term gas contracts,” the CEO continued. “They are happy to put in a bigger facility if we need it,” Reid said, but the question is whether SDX requires the cash as this will also increase the expense.

Gas from the SDX assets is going to meet industrial demand in the Atlantic Free Zone. The company currently has eight customers, taking gas on five or 10 year take or pay contracts. “There’s a long tail of consumption and we need to ensure sufficient supplies,” Reid said. SDX is in the process of a 12-well drilling campaign, of which it has drilled seven, with five commercial discoveries.

Those five finds are enough to cover two to three years of consumption, the CEO said, suggesting a need to drill more to cover contracted demand.

The focus has been on the drilling of low risk wells thus far, but the company is about to shift to targeting larger resources. “The next two wells have been selected to test that thesis, of whether prospectivity extends to the north,” Reid said, noting the first of these was already being drilled and with results due next week.