Zenith Energy has extracted better still terms from embattled Anglo African Oil & Gas (AAOG) on the sale of the Tilapia oilfield, in Congo Brazzaville.

The purchaser will now pay only £200,000 for AAOG’s stake in Tilapia, in addition to debts owed to AAOG’s local unit. Locally state-owned Société Nationale des Pétroles du Congo (SNPC) owes AAOG Congo $5.3 million.

Zenith set out its first agreement to buy into Tilapia at the end of December 2019. At that point, it was to acquire an 80% stake in AAOG Congo unit for £1 million, half of which was to be paid in cash and half in shares. In March, the terms were changed to £800,000 all in cash.

“Acquiring a 56% interest in the potentially transformational Tilapia oilfield, as well as 100% of the approximately US$5.3 million in receivables, for a consideration of £200,000 is a fantastic result made possible by the exceptional circumstances brought about by the COVID-19 pandemic, as well as the current low oil price environment,” said Zenith’s CEO Andrea Cattaneo.

The executive went on to express confidence in securing regulatory approval from the Congolese authorities for the transfer, in addition to the 25-year renewal of the licence.

Completion of the deal will occur after a vote by AAOG shareholders. It is no longer conditional on approval from Brazzaville.

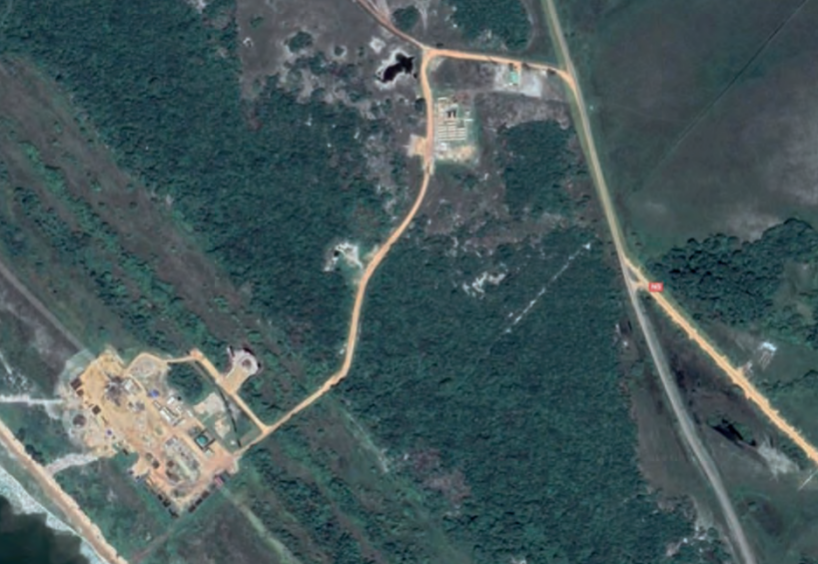

Once it has control of the AAOG Congo unit, Zenith said it would carry out cost cutting in order to improve profitability. The oilfield is producing only around 30 barrels per day at present, but drilling in the Mengo and Djeno reservoirs has been encouraging.