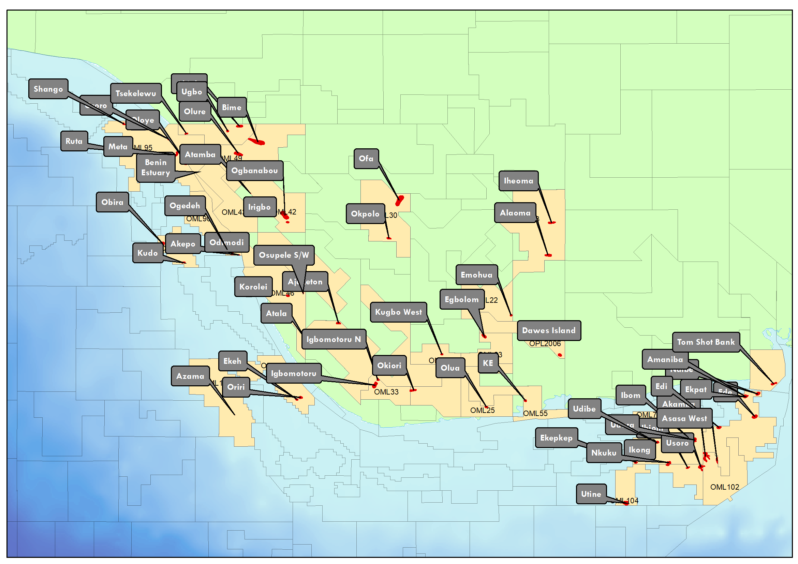

Nigeria has officially launched a marginal field bid round, with the Department of Petroleum Resources (DPR) saying 57 fields are available.

The round is open to indigenous companies and investors, the DPR said. The fields on offer are on land, swamp and the shallow offshore.

“Bidders will certainly be led by indigenous companies, but these are likely to work in partnership with international oil companies wanting to participate in Nigeria. Local companies have been hit by the effects of covid and Nigerian-blend oil prices have been particularly squeezed,” Bracewell partner Adam Blythe told Energy Voice.

Should winning companies not be able to demonstrate progress on an awarded field within 60 months the Ministry of Petroleum Resources has the authority to cancel the farm-out agreement.

From the date of announcement, the agency said the process should not take longer than six months. The concluding phase will see the signing of farm-out agreements with leaseholders.

“It seems possible that companies could evaluate fields and be ready to sign in six months but how quick and willing the original licence holder will be to reach terms on an expedited basis remains to be seen,” Blythe said.

“Any bidding process in the current environment faces challenges, but marginal fields may represent less of a difficulty given they are typically smaller in scale, near to development and with lower capital costs.”

The DPR has set out a number of steps for bidders, with fees payable at various points. A registration fee of 500,000 naira ($1,290) is the first payment, a 2 million naira ($5,200) application fee per field, a 3 million naira ($7,800) bid processing fee per field, a data prying fee of $15,000 per field, a data leasing fee of $25,000 per field, a competent persons report fee of $50,000 per field and a field specific report of $25,000 per field.

Signature bonuses are also payable.