SDX Energy has sold its 50% stake in the North West Gemsa licence to privately owned Gulf Energy.

Gulf has paid $3 million for the interest, of which $1.4mn will go to paying off SDX’s liabilities on the licence. Leaving the company with $1.6mn, SDX said this exceeded its expectations for the asset.

“We are pleased to complete the sale of our interest in the North West Gemsa licence. Whilst we have presented our interest in the licence as non-core for some time, owing to its reducing production and marginal netbacks, it is a welcome outcome to be exiting the licence with a useful cash consideration and also avoiding the upcoming associated budgeted capex of approximately US$2 million for the year,” said SDX’s CEO Mark Reid.

“This deal demonstrates our continued focus on portfolio and capital management, and we look forward to recycling the cash into projects that will further enhance and grow our business in the future.”

The licence produced 3,076 barrels of oil equivalent per day gross in the three months to the end of March. SDX’s share was 1,538 boepd, down from 2,128 boepd in the first quarter of 2019, a decline of around 28%.

In its results for the first quarter, SDX said no infill wells were planned to be drilled this year. Production will continue to decline as a result of this and an increased water cut and falling reservoir pressure.

The planned spend of $2mn was to go on up to 10 workovers at the licence.

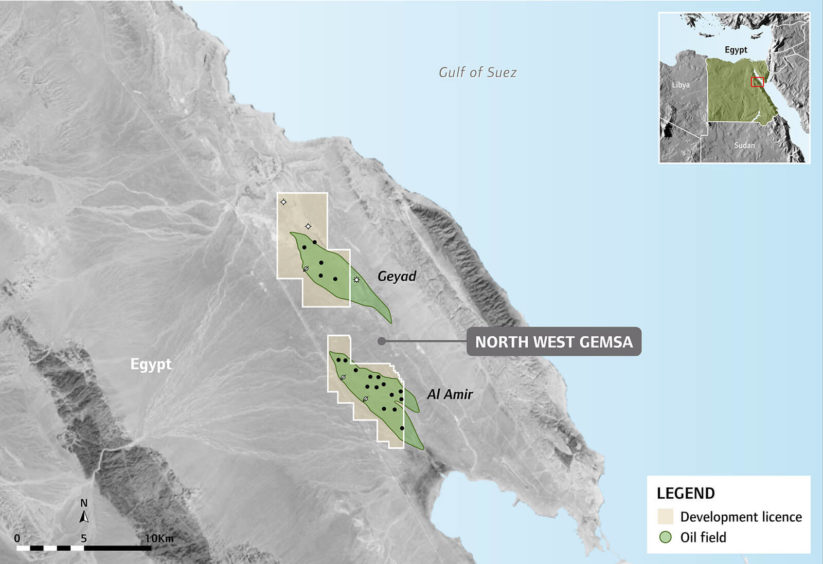

North West Gemsa covers 83 square km southeast of Cairo, adjacent to the Gulf of Suez. It holds three oilfields. SDX has previously noted the low cost of production at the area, at around $10 per barrel.