San Leon Energy continued its theme of paying out dividends, while projecting better times ahead as pipeline losses are expected to fall dramatically.

The company returned $35.3 million to shareholders in the first half of the year. CEO Oisin Fanning demonstrated his belief in the business model by buying another 98mn shares, taking his stake to around 24% in May. It announced a special dividend of $33.3mn in May.

San Leon receives cash from OML 18 based on payments for a loan it provided. In the first half, it was paid $41.5mn under the loan notes.

The company posted a loss from operations for the half of $20.3mn, although this does not include payments from the loan notes.

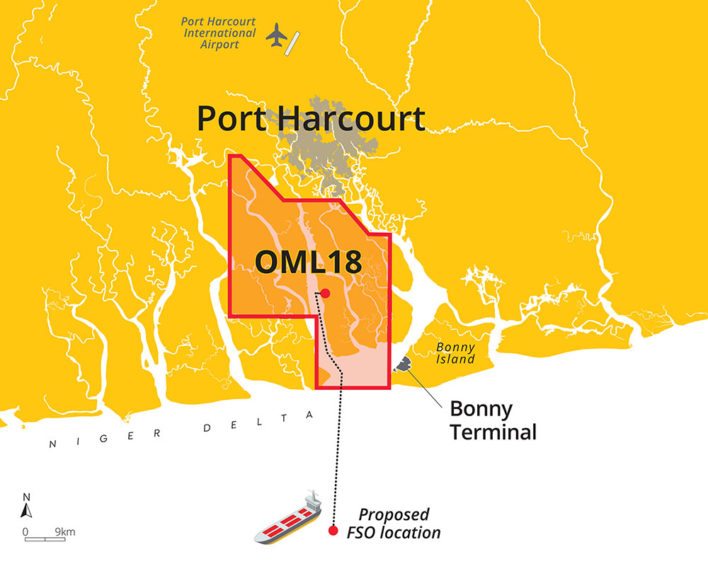

Losses continue to be high for exports. The consortium in which it works on OML 18 delivered 25,200 barrels per day of oil to the Bonny terminal in the half, down from 32,000 bpd in the first half of 2019. Losses and downtime were reported at around 32%. OPEC quotas also reduced production.

Production downtime was reported at 15% while pipeline losses were 20%.

New ACOES

The OML 18 partners are constructing a new pipeline link that should reduce losses to below 10%. The new Alternative Crude Oil Evacuation System (ACOES) will transport crude to a dedicated floating storage and offloading (FSO) facility, around 50 km offshore.

San Leon, in August, provided a $15mn loan to support the construction of the ACOES. The new pipeline should start in the “coming quarters”, the company said. This had been due to start by early October.

The company did not explain why ACOES had been delayed. It did mention the impact of COVID-19 on operations at OML 18. The pandemic slowed completion and starting of three wells drilled earlier at the licence.

Operator Eroton Exploration and Production has taken steps to cut costs in the face of lower recent oil costs. As such it has delayed a next drilling campaign, which is now expected towards the end of 2021.