Big companies have big plans to cut emissions and often find it easier to sell assets. Buyers may not be quite so concerned about tackling emissions, though, a report from the Environmental Defense Fund (EDF) has found.

EDF, a US-based group, used research from Capterio and ESG Dynamics.

The report, “Transferred Emissions: How Risks in Oil and Gas M&A Could Hamper the Energy Transition”, flagged three transactions in particular. Two were in Texas and one in Nigeria.

“In certain instances, then, upstream asset transfer can significantly disrupt efforts to curb atmospheric warming,” EDF’s report said.

OML 17

Shell, TotalEnergies and Eni agreed to sell down a stake in OML 17 in January 2021 to Trans-Niger Oil and Gas (TNOG). Shell’s local unit reported a total payment of $533 million, while Total received $180mn.

One field on this licence is Umuechem.

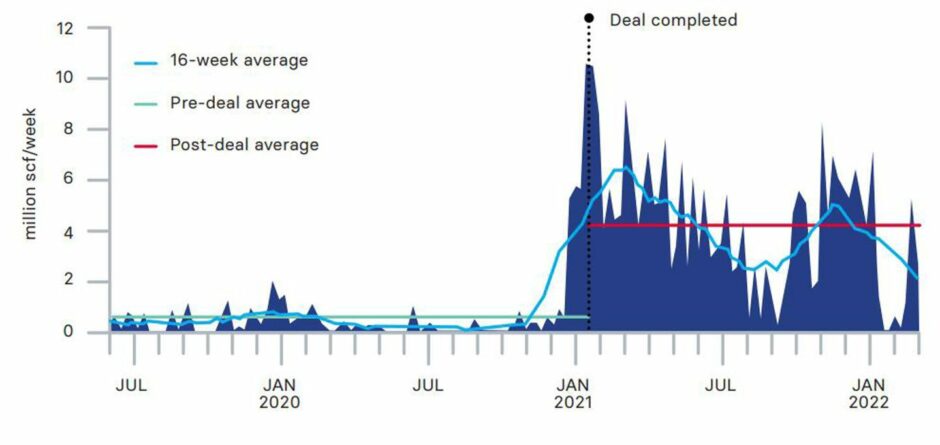

From 2013 to the point it was sold, the report said there was no routine flaring. Since the sale, flaring at the field has run at around 4.1 million cubic feet per week.

EDF’s report described TNOG as having no climate commitments. “Following the transfer, flaring, a significant source of methane emissions, rose dramatically, with average weekly flaring more than quadrupling,” it reported.

This increase in flaring shows how “handing the keys to a less responsible operator can trigger significant climate consequences”.

The three sellers have all made environmental commitments around disclosures, flaring and to reaching net zero. TNOG, part of Tony Elumelu’s Heirs Holding, has not.

Elumelu is reported to have set the goal of tripling production from OML 17.

An Eni representative said asset sales must comply with local regulations. “Eni is collaborating with peers and with EDF to promote the adoption of clauses related to methane emissions reduction and reporting criteria, to be included in Joint Agreements. Finally, an asset sale is not considered by Eni as a tool to reduce emissions.”

Obligations

“Transfer may help majors begin to execute their energy transition plans, but it does not help reduce global greenhouse gas emissions,” EDF said. To reach net zero by 2050, companies must integrate climate considerations into oil and gas deal making.

EDF called for participants to embed climate safeguarding into deals.

Afreximbank was the largest lender to the TNOG deal, via a $250mn reserve-based lending (RBL) facility. Other lenders included Africa Finance Corp., Union Bank, Shell, Hybrid Capital and Schlumberger. Afreximbank also acted as one of the mandated lead arrangers, alongside Standard Chartered and ABSA.

Afreximbank and Heirs Holding have not yet responded to a request for comment.

“Sellers are mindful of who they’re selling to and they should encourage continuous good practice. But buyers also have an obligation as, in my opinion, do brokers, banks and lenders who support the deals. They should be cognisant of their obligations,” said Capterio CEO Mark Davis.

“I would like to see some voluntary code of conduct from those who support transactions” with the aim of improving corporate governance among buyers.

Davis also echoed the concerns around reduced disclosure as a result of asset transfers. “Some buyers are as good or better. But the disclosure trend is not looking good.”

© Supplied by EDF

© Supplied by EDF