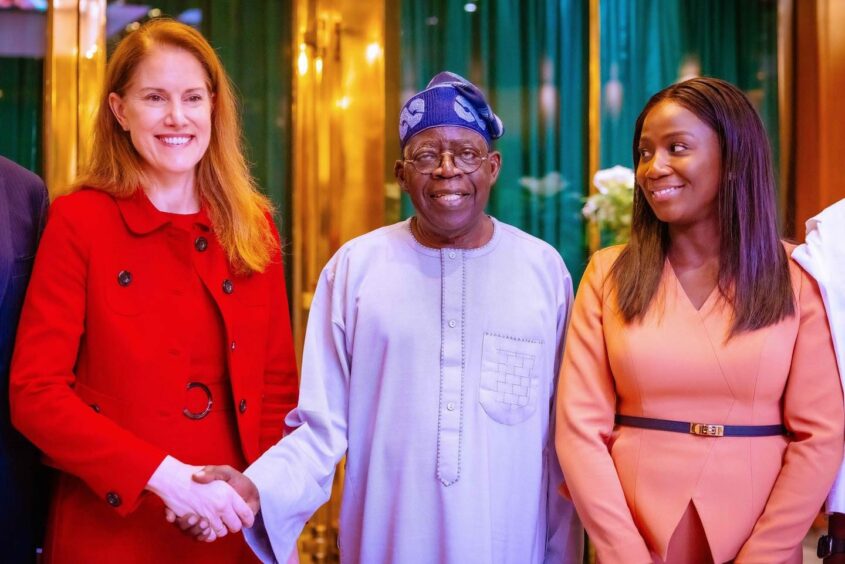

© Supplied by Nigerian presidency

© Supplied by Nigerian presidency Shell (LON: SHEL) has reached a deal to sell its onshore Nigerian business to a group of local companies for $1.3 billion.

The sale will allow the supermajor to focus on deepwater and gas – including its retained stake in Nigeria LNG (NLNG).

Renaissance, a five-company joint venture, will acquire Shell Petroleum Development Co. (SPDC).

Completion is subject to approval from the Nigerian government and other conditions. This has not always been straightforward for asset sales. Seplat Energy is still working on a deal for ExxonMobil’s onshore assets, for instance.

In addition to the $1.3bn paid, Renaissance will pay up to $1.1bn, on receivables and cash balances for the business. The joint venture will pay most of this on completion.

On closing, Shell will provide $1.2bn in secured loans. It will also provide additional financing of $1.3bn in the future to cover the development of feedgas for NLNG and its share of “specific decommissioning and restoration costs”.

SPDC staff will continue to be employed by the company as the ownership change occurs. Shell will also play a role in managing SPDC facilities that provide gas to NLNG.

“This agreement marks an important milestone for Shell in Nigeria, aligning with our previously announced intent to exit onshore oil production in the Niger Delta”, said Shell integrated gas and upstream director Zoë Yujnovich.

The sale simplifies the portfolio and focuses “future disciplined investment in Nigeria on our deepwater and integrated gas positions”, she said.

Next chapter

The sale for SPDC will mark its next chapter “under the ownership of an experienced, ambitious Nigerian-led consortium. Shell sees a bright future in Nigeria with a positive investment outlook for its energy sector. We will continue to support the country’s growing energy needs and export ambitions in areas aligned with our strategy.”

Shell has a 30% stake in SPDC. TotalEnergies owns 10% while Eni’s Nigeria Agip Oil Co. (NAOC) has 5%. Nigerian National Petroleum Co. (NNPC) owns the remaining 55% stake. Total has not yet responded to requests for comment on its plans.

Eni struck a deal in September 2023 to sell down four licences to Oando. The company is not selling out of the joint venture.

SPDC owns 15 licences onshore and three in the shallow water, OML 74, 77 and 79. It has 458 million barrels of oil equivalent in proved reserves, as of the end of 2022.

Shell said the entity had a net book value of $2.8bn as of the end of 2023. The buyer assumes economic control of the venture as of the end of 2021.

The company said it expected to recognise impairments up to the date of completion, with the book value exceeding the price paid.

The deal does include associated infrastructure, such as the Bonny Terminal.

Local challenge

Shell began seriously talking about Nigerian sales of its SPDC asset in 2021. The company has struggled to operate in the onshore, where it faces theft and sabotage of pipelines and facilities. In 2021, an ambush killed six contractors.

Renaissance is made up of ND Western, Aradel Energy, First E&P, Waltersmith and Petrolin. Petrolin, Aradel, Waltersmith and First E&P formed ND Western as a special purpose vehicle to manage OML 34. It bought this asset in 2012 from Shell.

A statement from Renaissance confirmed the “landmark transaction” for Shell’s stake in SPDC.

Renaissance said the company was “committed to ensuring a smooth transition and look forward to leveraging our expertise, in partnership with SPDC’s industry-leading staff and working in partnership with all the stakeholders in the SPDC-JV to drive continued growth and success in Nigeria and beyond”.

Tony Attah, former head of NLNG, is the CEO of Renaissance, which also employs a number of other ex-Shell officials.

Welligence senior analyst for sub-Saharan Africa Ifeanyi Onyegiri warned the sales process was “lengthy and bureaucratic”.

The analyst noted this was the fourth corporate sale involving a major in the last two years. “The other transactions have involved the ExxonMobil JV, NAOC JV (Eni) and Equinor. But none have been signed off by the government.”

Environmental impact

It will not all be plain sailing. Fyneface Dumnamene Fyneface, director of Youths and Environmental Advocacy Centre (YEAC-Nigeria), called for Shell to recognise its liabilities.

“I strongly believed that Shell has lots of liabilities especially those relating to Court judgements for payment of compensation to communities that they polluted as well as oil spill clean up cases that they needed to address before talking about sales of their onshore oil stake,” said Fyneface.

He said Shell had not addressed issues from the Ebubu community, in Ogoniland. Renaissance, the YEAC director said, should be aware of the liabilities.

The buyers should ensure some equity goes to local communities, Fyneface said. This would “create … an enabling environment for the smooth operation” of the assets.

Shell has committed to paying $1 billion into the Ogoni Trust Fund, to carry out remediation work in Ogoniland. As of the end of 2022, it had paid nearly $600 million into the fund and it will continue making payments.

Updated at 12:09 to confirm Eni’s continued participation and at 2:18 pm to correct the statement on terminal ownership.

Updated January 17 at 9:50 am with Welligence comment.