Reconnaissance Energy Africa is disclosing more information on its efforts, even while short sellers maintain criticism of its plans.

ReconAfrica CEO Scot Evans was hosted at a Goldman Sachs event this week, suggesting the company was in talks with potential partners. Someone leaked a recording of the talk.

ReconAfrica is “quite actively” looking at ways to graduate to a more senior exchange, he said. He declined to give specifics about which exchange it might be considering.

Evans confirmed ReconAfrica was also considering monetisation plans for oil from potential production. Initially, the plan would likely involve trucking crude around 100 km to a rail terminal. It would then be carried by rail to the deepwater port at Walvis Bay.

The CEO also said he was “really excited” about the prospect for gas-to-power.

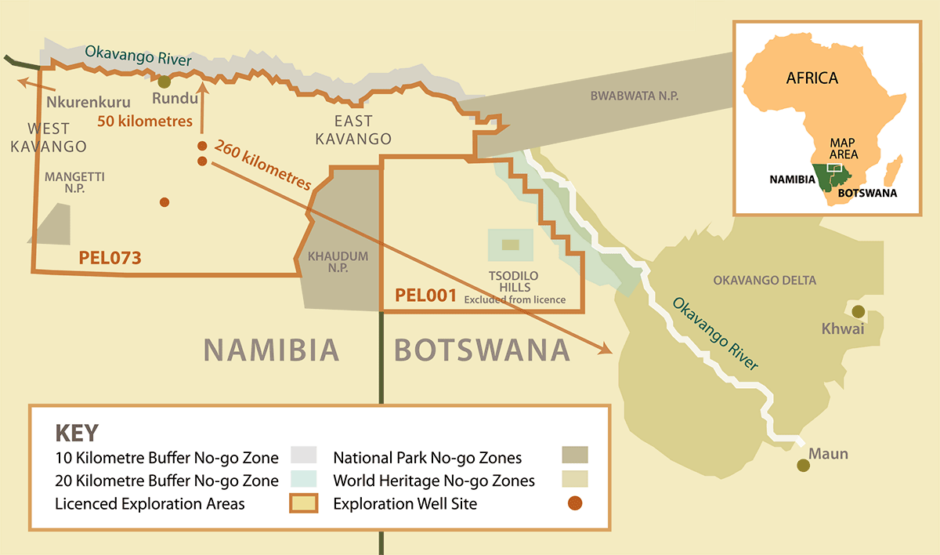

Seismic acquisition is under way in Namibia. When this is complete, at the end of the year, the company will “start to look at the process of partnering. We’re building a team at ReconAfrica that can go from exploration to development planning to production. It’s a very large area … we’ve identified five sub-basins.”

Two companies have contacted ReconAfrica to express interest in the opportunity so far, he said.

Rolling rocks

“The first two wells confirm there’s an active petroleum system here with oil and natural gas shows,” Evans said. Data from Core Labs show stacked reservoirs, the CEO continued. ReconAfrica believes the area to have oil with associated gas, he said.

Providing more geological information, Jim Granath set out some findings from the company’s 6-2 well, known as Kawe, at the PESGB / HGS Africa E&P Conference 2021. Granath’s comments will be available via the conference until October 29.

The wells were stratigraphic, Granath said, and intended to give an idea of the basin and hydrocarbons presence. The company reported oil shows on the Kawe well.

There are indications of “migrated petroleum that are potentially producible, repeated in several horizons”, Granath said. “What we need to emphasise is that this is not the be all and end all.”

ReconAfrica “didn’t expect to get the shows that we got. I wouldn’t call them discoveries but they do look like some sort of accumulated column and there are thermogenic hydrocarbons. We’re now doing seismic imaging to get some insight into the aspects.”

Data plans

Given the nature of the wells, the company did not carry out drill stem testing (DST), he said. It did recover small samples from the wells and is attempting to carry out geochemical analysis.

Polaris Seismic is carrying out the 450 km of 2D seismic, with Stryde nodes.

“The western half [of the seismic] is in the can,” Granath said, although reporting there were some noise problems. The company may go on to shoot more seismic than first thought, he said, with the government keen to provide support. The company is already processing the data.

It plans to acquire more seismic to define structures. This would move the company’s understanding beyond the broad-brush one-line coverage.

ReconAfrica’s new thinking on the area suggests there are two sources for the shows, Granath said. “People have advocated source rock in the pre Cambrian. I think there’s been some Karoo generation,” he noted, although allowing this was still an open question.

There is the possibility of reservoirs in the carbonate and the Karoo sections.

Opposition

As ReconAfrica’s understanding of the play has evolved, it has moved away from its initial suggestion of an unconventional play in northeast Namibia. This had been why the company first licensed the area, but as evidence of the Kavango Basin’s difference to the Owambo became clear, interest shifted.

Environmentalists targeted ReconAfrica, initially for its hydraulic fracturing plans. As the company has shifted away from this, other concerns have risen, around concerns on water impacts and the local wildlife.

The International Union for Conservation of Nature (IUCN) called for more scrutiny of operations at a recent congress.

Granath noted that the company had been “kicked around a lot for non-scientific reasons”. Much of the scrutiny has been “driven by short sellers in the stock and naysaysers. We’ve been the victim of an incredible barrage of hacking attacks on all our computer systems.”

One noted critic of ReconAfrica is Viceroy Research’s Fraser Perring, who seemed little swayed by the various plans set out.

One expert questioned the near-zero oil shows, @Recon_Africa have yet to answer. In fact, they've evidence little so far but are talking about marketing the oil, monetization & generating electricity for the grid (Gas to power with what?). #120BillionBarrelsofBullshit pic.twitter.com/ooM9kyxllK

— Fraser Perring – Grand Poobah of “criminal” shorts (@AIMhonesty) September 14, 2021