Panoro Energy has completed the sale of its stake in Nigeria’s OML 113 to PetroNor E&P.

Panoro had a 6.502% stake in the licence, with a 16.255% cost interest, giving it an economic interest of 12.191%. The company now has no presence in Nigeria.

PetroNor paid $10 million up front, with a future contingent payment of $16.67mn due on gas production volumes. The stake is around 7% of PetroNor.

The buyer is making the purchase in the transfer of 96.6mn new shares, which Panoro will distribute to its shareholders.

PetroNor interim CEO Jens Pace welcomed the closing. “The acquisition of the ownership interest in the Aje field is strategically attractive and supports our stated growth strategy of acquiring assets that add production, material reserves and resources to the company,” he said.

“With the establishment of Aje Production, YFP and PetroNor will form a dynamic and effective licence partnership to lead the redevelopment of the Aje field.”

PetroNor will hold its stake via a joint venture, Aje Production, with Yinka Folawiyo Petroleum (YFP). PetroNor will have 52% and act as technical operator, while YFP will have 48% in the venture.

It will have a 15.5% participating interest and an economic interest of 38.755% in OML 113.

Long road, big plans

PetroNor and Panoro struck the deal in October 2019, with an initial long stop date of December 31, 2020. Nigeria Upstream Petroleum Regulatory Commission (NUPRC) approved the sale in January 2022.

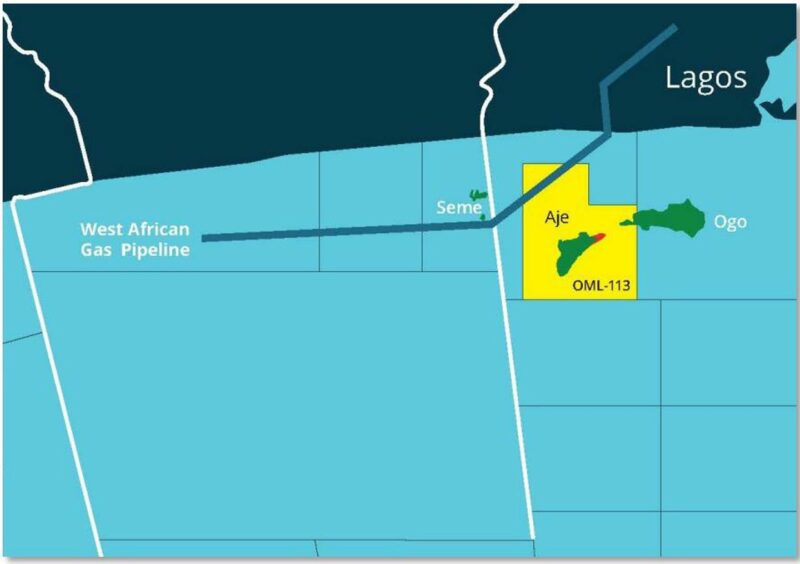

The licence is close to Lagos and the West African Gas Pipeline (WAGP). PetroNor has set out plans to develop the gas resource on the licence.

It has said it is updating the field development plan to expedite gas development, while holding talks with potential offtakers and partners. The company said its gas supplies could generate 500 MW of power, displacing diesel, while also providing 10% of Nigeria’s LPG.

Panoro CEO John Hamilton said the company’s shareholders would continue to benefit from work on OML 113 through the share transfer and the contingent payment.

“This also represents a key milestone for Panoro’s strategy with the first dividend payment to its shareholders. Meanwhile the board and management of the company remain fully committed to initiating sustainable cash dividends at the earliest opportunity and to unlock further value for its shareholders.”

Norway’s anti-corruption agency Økokrim arrested PetroNor CEO Knut Sovold in December 2021. In April this year, the US Department of Justice (DoJ) named the company’s chair, Eyas Alhomouz, as a suspect. Økokrim has said the charges relate to the executives’ actions, not to the company.