Things are looking up for San Leon Energy (LON: SLE), with the company closing in on the completion of its Nigeria deal and managing to avoid the termination of its listing on London’s AIM.

On July 8, the company faced a deadline of publishing its admission document on how it would reorganise its OML 18 partnership – or lose its AIM listing. San Leon managed to publish that day and has now returned to trading, after just over a year of suspension.

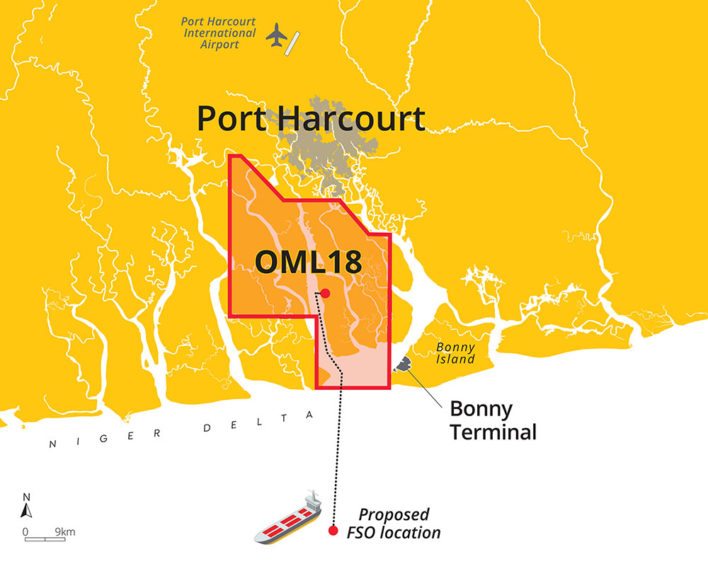

At the heart of the deal is a move to clean up the ownership of OML 18, a formerly Shell held asset in Nigeria.

San Leon had held a 10.6% stake in the licence, held via a 40% stake in MLPL, which owned Martwestern, which has a 98% stake in Eroton. The latter owns a 45% stake in OML 18.

The deal San Leon has been working on for so long sees it take a 98% stake in Eroton, giving it an effective stake of 44.1% in OML 18. While Bilton Energy will continue to participate in the licence, via the outstanding 2% in Eroton, Sahara Group will no longer be involved.

Eroton will pay Sahara $485 million, of which $75mn will be vendor financed, for its 16.8% stake. Nigerian National Petroleum Corp. (NNPC) owns the remaining 55% in OML 18.

Once the dust settles, Midwestern will have swapped its 60% stake in MLPL for a 55% stake in San Leon.

Making merger sense

San Leon has profited from a loan it provided to MLPL worth $174.5 million in 2016, which had an annual 17% coupon. “Where were we going to go next?” San Leon CEO Oisin Fanning asked. The 10.6% stake in OML 18 was fairly small and “wasn’t particularly super exciting”, he noted.

Given the relationship with Midwestern chairman Onajite Okoloko a merger “just made more sense. Here you have a growth company in Nigeria that needs access to capital. The licence is around 1,000 square km, there’s at least 600 million barrels recoverable, there’s a lot of gas.”

Combining the two companies would see them grow together, he continued. The 45% owned by Eroton has “huge potential for growth”.

Paraphrasing the complicated deal, Fanning said it would see San Leon double the number of its shares but with four times the asset exposure.

Infrastructure

Another part of San Leon’s proposal is the new pipeline. The Niger Delta is infamous for oil theft, with reports indicating this has only got worse in the last year.

OML 18 has not been immune from this. The licence delivered around 4,400 barrels per day of oil to the Bonny terminal in 2021, down from 21,100 bpd in 2020.

This is on the verge of changing. Energy Link Infrastructure (ELI) is building a new pipeline, which it calls the Alternate Crude Oil Evacuation System (ACOES). This should be in operation by December, Fanning said.

ACOES will run to an FSO around 50 km offshore. Shell continues to act as offtaker for oil from the asset. San Leon will end up with a stake of just over 50% in this link. Even if prices dip, the ACOES will still be available for exports and for other operators to use – and to pay tolls.

In the meantime, as of last weekend, the operator has begun using barges to move its crude. This has reduced theft and losses to “zero”, the San Leon official said. “Theft disappears overnight. It was averaging 35-40% for us and had gone up during COVID.”

Exports via barge cost around $17 per barrel, while the pipeline will reduce this to $5. Paying that extra premium to export via barge was “worth every penny compared to having it stolen”, Fanning said.

Assuming production grows in the area, there may be scope for additional pipeline export works.

Scaling up

The decision was taken to turn down crude production while so much of it was being lost and stolen. Now, with improved security, production should rise. Fanning said it would take four to six weeks to restore each well. He predicted that, by the end of the year, production would return to around 40,000 bpd.

By this July 2023, he said the asset could be producing 80,000-100,000 bpd.

The previous operator did not exploit the wells to their full potential. Existing wells have potential to tap additional productive zones, Fanning said. “The only question is how to get the equipment and the cash in.”

Shell drilled 175 wells on the licence before selling out. San Leon is in the process of working out which of these wells may have additional potential.

Shell had been producing at around 80,000 bpd although volumes fell as a result of community problems. The Eroton team now employ around 600 people for security and, as a result, vandalism has fallen.

“Providing jobs to local people is vital. You have to set up something. You can’t have a bloody big pipeline going through someone’s land while they’re on the breadline,” he said.

One area of potential growth is in gas production. Fanning said OML 18 had a “huge amount” of gas, but said the company would not be able to provide the infrastructure required. “We could turn it on but it has nowhere to go, without infrastructure.”

Corporate moves

While Nigeria’s hydrocarbon potential is clear, the country’s aboveground risks are a challenge for many. Demonstrating the challenge is Seplat Energy, which has been refused permission to go ahead with its proposed deal for ExxonMobil’s local unit.

Nigeria can seem a hostile place for operators, leaving financiers sceptical of providing support for such plans. Fanning pointed to the company’s history of providing the loan and seeing it paid back.

While there are some concerns around approval from the government, Fanning was unconcerned. “I’m not worried about that. We’ve got until the last quarter of the year, but I hope we can do better than that.”

Nigeria is “screaming out for more oil production”, Fanning said. Given this imperative, he said, it would be unlikely that it rules against the transaction. Given the scale of the opportunity at OML 18, San Leon has no plans to expand further as yet.

He also made a number of commitments around the corporate plans. San Leon’s free float is not large enough, Fanning said, and it plans to move to the Main Market on the London Stock Exchange within six to eight months.

Finance plans

The UK has posed an increasing number of challenges for oil and gas companies, particularly those working in Africa.

Acknowledging this, Fanning said the company had announced a new facility on July 8 for $50 million, to finance its ELI investment and for working capital.

This cash came from Abu Dhabi, the executive noted. “There are people in the United Arab Emirates who understand the oil and gas business and are not frightened by super green shareholders.” San Leon is working to firm up its relationship with UAE financiers and is “exploring” a dual listing on the Abu Dhabi stock exchange.

“We have to find countries that are not afraid of Africa, and Nigeria in particular. There’s a huge hunger to invest from the UAE. If we want to be a multi-billion company, we’re going to need access to capital.”

Part of Fanning’s strategy involves an unusual commitment to paying dividends. The company has already made substantial returns and this is set to continue as free cash begins to flow from OML 18.

There are clearly risks ahead, around government approval, around security, around financing. But San Leon has a real chance to become a significant producer, linking up access to capital with local Nigerian links.

© Supplied by San Leon Energy

© Supplied by San Leon Energy