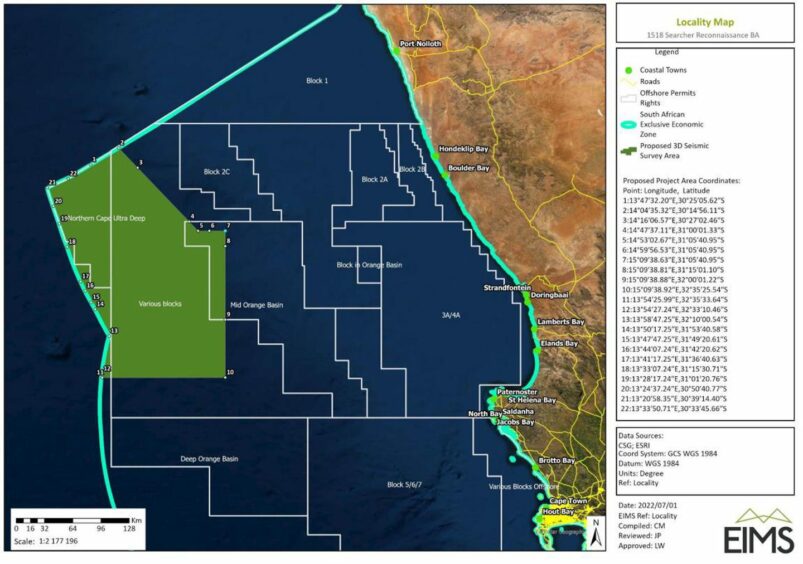

Searcher Seismic has filed for a new application to shoot 3D seismic offshore South Africa, in what is set to be a new test for the country’s willingness to approve such work.

Two seismic surveys were shut down at the start of the year as a result of local objections.

Searcher submitted a new request for approval this week. The company has appointed Environmental Impact Management Services (EIMS) to assist in the application.

The application said the area of interest was around 30,000 square km. The shoot would take around 127 days, including downtime.

Assuming the regulator grants approval, Searcher intends to carry out the seismic shoot in the first quarter of 2023.

The regulator, Petroleum Agency SA (PASA), is determined to reopen the country to seismic plans.

“The consultation is critical,” PASA CEO Phindile Masangane said, speaking at DFFE, DMRE and PASA pre-colloquium event in South Africa today.

“The push back sometimes is not informed by the latest technological developments. We want consultations to be meaningful. We will publish new guidelines this December on how to consult with communities,” she said.

Protecting the environment was a priority, Masangane said, but so too was creating employment and providing benefits to the economy.

Exploration frontiers

PASA COO Bongani Sayidini concurred. Seismic, he said, was an essential part of the exploration process. Halting these plans “is chasing away investment,” he said. “If we are not exploring for oil and gas … we can kiss goodbye to energy security.”

Sayidini said there had been at least 12 seismic surveys in South Africa in the last five to 10 years. “Can anyone point to a negative impact? Total acquired seismic on Block 5/6/7 in 2019. There was no impact,” the PASA official said.

Sayidini noted Shell’s (LON:SHEL) success in Namibia, at the Graff and La Rona wells, in addition to TotalEnergies (LON:TTE) at Venus. “We must engage in conversation but we must also have action,” he said.

Total has said it is planning a well on Block 5/6/7 in late 2023 or the first half of 2024. Eco Atlantic is working on drilling plans in its Block 3B/4B. Both of these are in the same Orange Basin that the Venus, Graff and La Rona discoveries have occurred.

Gas driver

PASA estimates the country has around 27 billion barrels of oil, in prospective resources, and 60 trillion cubic feet of gas. Converting some of this potential into proven reserves would be transformative for the country.

He highlighted, in particular, TotalEnergies’ gas plans off the southern coast at Brulpadda and Luiperd. The two wells have found 3.4 tcf, with Luiperd the larger at 2.3 tcf.

A first phase development involving three or four wells could reach first gas in 2027 with production of around 560 million cubic feet per day. Around 210 mmcf of this, and 18,000 barrels per day of condensates, could go into PetroSA’s Mossel Bay gas-to-liquids (GTL) refinery. The remainder could go to local power plants, with the nearby oil-fired 740 MW Gourikwa a prime candidate.

The partners in the find would need to invest $2.5-3 billion, Sayidini said.

New feedstock for the GTL plant would restart operations at the facility. It shut down in 2020. This would create new employment. Furthermore, the offshore development would use existing infrastructure, allowing the government to push back around 12 billion rand ($700mn) in decommissioning liabilities.

Future proof

Steve Nicholls, of the Presidential Climate Commission, said the country needed to think about the future and how demand would change.

A number of countries have set goals of banning the sale of internal combustion engines. This will “seriously constrain” the market for liquid fuels, Nicholls said.

Hydrocarbon developments must recover their costs within 28 years, he said, and must have a use case in industry. Furthermore, domestic gas developments must prove they can be cheaper than on the global markets, which will also face declining prices on lower demand, he said.

“More jobs will be created in transition than in sticking with existing industries,” Nicholls said. “There’s a need to achieve energy security but we can do that through a stable low carbon fossil fuel free system. The balance of payments is a big concern – but that doesn’t mean we cant do it.”

© Supplied by EIMS

© Supplied by EIMS