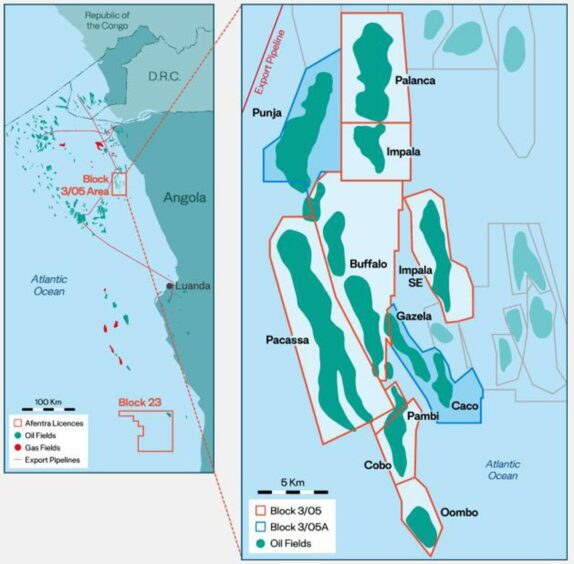

Afentra has struck a second deal in Angola, boosting its stake in Block 3/05, via an agreement with Croatia’s INA.

Afentra will pay an initial $9 million for the 4% stake in Block 3/05 and $3mn for a 5.33% stake in Block 3/05A. The company struck a deal with Sonangol in April this year for a 20% stake in Block 3/05.

Afentra will owe another $10mn on the extension of the Block 3/05 licence, with up to $6mn due over three years based on oil prices.

Another payment of up to $5mn on Block 3/05A will come due on the successful development of some discoveries and oil prices. The deal has an effective date of September 30, 2021.

CEO Paul McDade said the deal was “strategically attractive” given that it adds more exposure to “proven assets with significant upside”.

Adding another 4% to its Block 3/05 stake “demonstrates our commitment to both the asset and our plan to work with the operator, Sonangol, to maximise the production and recovery from this material asset for the benefit of all stakeholders”.

After closing both deals, Afentra will have a 24% stake in Block 3/05. The cost works out to around $4 per barrel of 2P reserves, with breakeven costs of $35 per barrel. Total 2P reserves to Afentra will be around 24mn barrels with production of 4,680 bpd.

Block 3/05A has around 300mn barrels of oil in place, with one partially developed discovery and two undeveloped. The company said it could tie these finds back into existing infrastructure on Block 3/05, with the potential for around 10,000 bpd gross production.

Block 3/05 has around 3 billion barrels of oil in place, with eight fields and more than 100 wells.

Forward facing

Afentra expects to fund the INA deal from the same source as the Sonangol deal. Talks are “well advanced”, it said, and will be finalised before readmission. With oil at $75 per barrel, Afentra expects the deal to payback within three years.

The company expects to publish its AIM re-admission document, and resume trading, in the coming weeks. It plans to complete both the INA and Sonangol deals in the second half of this year.

Sonangol has a 30% stake in Block 3/05, Maurel et Prom 20%, Eni 12%, Somoil 10% and Naftagas 4%. Afentra will be the second largest in the block with its 24% stake. The block produced 19,500 bpd in the first half of the year, with Afentra saying it has the potential to reach 30,000 bpd.

Afentra clearly intends to add more deals to its portfolio, following the same model as its Angola transactions.

McDade said the agreements “provide a solid foundation for Afentra’s growth in Angola, and elsewhere within Africa, our geographic focus. They also demonstrate the significant opportunities that exist in the region, for a responsible and ambitious independent like Afentra, that are resulting from the transition that is ongoing in the oil and gas industry in Africa.”

© Supplied by Afentra

© Supplied by Afentra