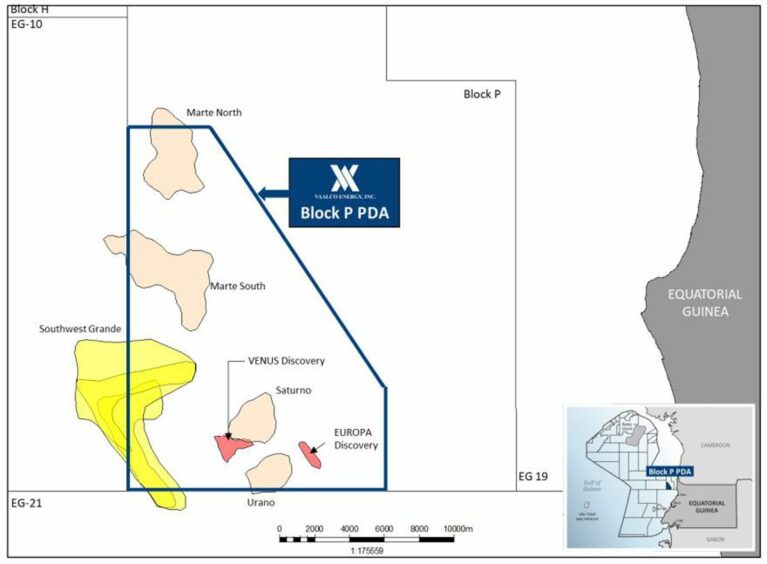

Equatorial Guinea has approved the Venus plan of development hatched by Vaalco Energy, targeting first oil in 2026.

Vaalco has an 80% stake in the project and is the operator. The plan covers two development wells, an injection well and production facilities, with a total cost of $310 million.

The 15,000 barrel per day Venus will add 23.1 million barrels of oil in gross reserves, and 18.5mn barrels in working interest reserves. Vaalco has put the development at a cost of $13.4 per barrel of 2P reserves.

Vaalco CEO George Maxwell welcomed the step from the government. “We are very excited to proceed with our plans to operate, develop and begin producing from our discovery at Block P in Equatorial Guinea over the next few years.”

He described the plan of development as “strong and highly economic” and that such a step for Vaalco “further demonstrates the meaningful value of our asset base. We believe that Block P in Equatorial Guinea has the upside potential to become a world-class asset in line with our Etame asset and see clear strategic benefits in diversifying the revenue generation and country focus of our portfolio.”

The company submitted its plan of development on July 15.

Atlas Petroleum International, which also has a stake in Block P, opted not to participate in the plan. As such, Vaalco’s only partner on the work will be state-owned Gepetrol, with a 20% stake.

Drilling down

Vaalco plans to spud the first development well in early 2024. It will drill another development well and the water injector in 2025-26.

Nearby Venus is the Europa discovery, which holds another 7.9mn boe in unrisked gross 2C resources. There is also the SW Grande prospect, with a potential 164.4mn boe.

Devon Energy drilled the discovery wells in 2005. The US-based company sold off its assets in 2008 to Gepetrol.