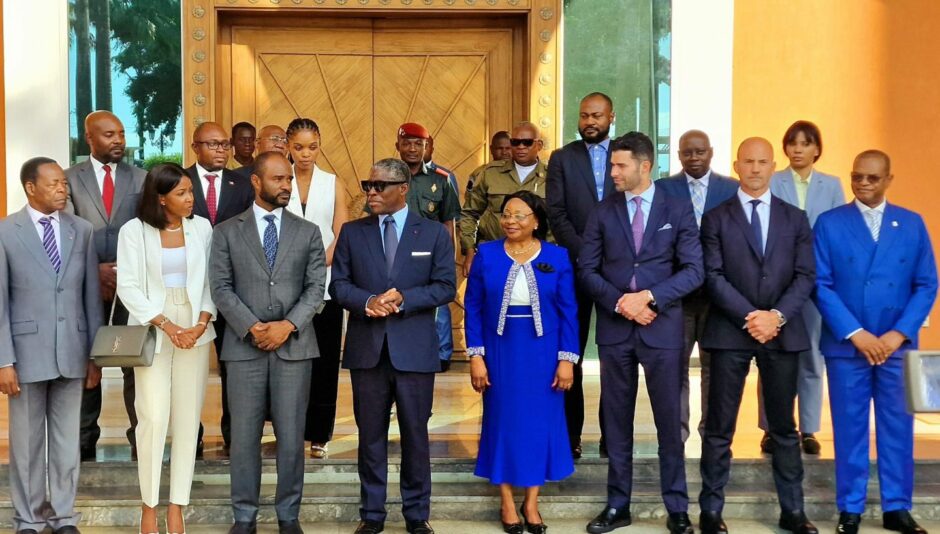

© Supplied by Vice President Vice

© Supplied by Vice President Vice Europa Oil & Gas has struck a deal to buy a 42.9% stake in Antler Global, which has a licence offshore Equatorial Guinea.

Antler won a production-sharing contract (PSC) on EG-08 in May this year, where it holds an 80% stake. State-owned Gepetrol holds the remaining 20%.

Europa is paying $3 million to acquire the stake in Antler. The buyer said the funds would be used for first year costs, including the acquisition of existing 3D seismic, which it will reprocess.

Drill plans

The first two year term of the licence does not require the companies to drill. However, Europa said it believes there are already drill-ready prospects, with three independent targets.

Antler plans to farm down its stake in the block, bringing in a partner capable of funding drilling.

EG-08 is east of Bioko Island, to the north of Chevron’s Alen and Aseng fields, in Blocks O and I. According to a Europa presentation, Prospect A is 9 km from a wet gas processing platform on the Alen field. All three prospects are close to the Chevron fields.

A well has been drilled on EG-08 in the past but was found to be dry. Europa said this well had found some condensate and had proved existence of reservoir.

Europa put total Pmean mid case prospective resource at 1.386 trillion cubic feet of gas equivalent. It expects the overall chance that one of the three prospects is commercial to be 91%. All three prospects can be drilled from a single well with two sidetracks.

The cost of drilling such a well with a jack-up would be around $50 million.

Europa CEO Will Holland said the deal was potentially transformational for the company. It “adds another high-impact exploration prospect to our portfolio and ties with our strategic approach to replenishing the portfolio with potentially high impact but relatively low risk prospects”.

Europa will pay the $3mn to Antler in four tranches, with the last due in October 2024. Holland will sit on Antler’s board to represent Europa.

Block Energy’s Paul Haywood and Christopher Irons set up Antler, according to Europa. Companies House reports Simon Barry as a director, who was also on Block’s ESG committee, rather than Irons.